Frequently Asked Questions

- State-Facilitated Retirement Savings Program Models

- Auto-IRA Common Program Design Features

- Fee Structures Across State Programs

- Positive Impact of State Programs on Private Employer-Sponsored Plan Formation

- Employer and Employee Program Experience

- Comparison of the Basic Features of an IRA and a 401(k)

- A Comparison of Traditional IRAs and Roth IRAs

- Vendors Servicing State-Facilitated Retirement Savings Programs

State-Facilitated Retirement Savings Program Models

What are the different types of state-facilitated retirement savings program models?

Among the states, four program models have emerged so far to expand private sector worker access to retirement savings options. These models are:

- Automatic-IRA: The Automatic IRA (Auto-IRA) model requires employers that do not otherwise already offer a retirement plan to allow their workers to be automatically enrolled in the state-facilitated retirement savings program. IRAs are considered personal savings accounts, not employee benefit plans, established and controlled by individuals, not employers, and therefore are not subject to ERISA. With state Auto-IRA programs, the role of the employer remains administrative only, restricted to enrolling workers and facilitating the payroll contribution. Employers also are prohibited from contributing to their employees’ accounts.

- Payroll Deduction IRA: In many respects, the program design is like an Auto-IRA program but differs in two important ways: 1) Employer participation in the program is voluntary and, if participation for employers is voluntary and not required by the states, then 2) there is legal uncertainty on what extent it can use auto-enrollment.

- Multiple Employer Plan (MEP): A MEP is commonly an ERISA 401(k) plan where several employers band together. As with a “single employer”401(k), MEPs offer higher contribution limits than an IRA and potentially an employer contribution or match, allowing both employers and employees to contribute. Because state-facilitated MEPs are 401(k) benefit plans regulated by ERISA, a state cannot require employer participation. MEPs enable unrelated employers to join to form what is considered a single plan that can be administered by a third-party provider. Pooling the assets of numerous small and mid-sized employer 401(k) programs may allow the MEP to accumulate sufficient assets to negotiate lower fees for investment, recordkeeping, and other activities or services.

- Retirement Marketplace: Marketplaces are state-run “electronic clearinghouses” where businesses can find and compare retirement savings plans offered by private sector providers. Marketplaces usually include educational material that enables businesses to find and compare a diverse array of retirement savings plans that have been pre-screened to meet certain criteria in an apples-to-apples manner. In marketplaces, a diverse array of plans (IRAs and 401(k)s) can be pre-screened and regulated by the state to ensure certain standards.

Some states are creating programs that combine more than one element of these models. New Mexico, for instance, passed legislation to simultaneously establish a retirement marketplace and a voluntary payroll deduction IRA for employers. Other states and cities have considered, but not yet enacted, such tiered models. In June 2022, Hawaii enacted an Auto-IRA program that requires employees to opt-in and, if they do, then an employer must facilitate contributions.

For more information:

Source: Morse, David and Antonelli, Angela. (March 2021). State-Facilitated Retirement Savings Programs: A Policymaker’s Guide to ERISA and the Tax Code. Washington, DC: Georgetown University Center for Retirement Initiatives; State-Facilitated Retirement Savings Programs: A Snapshot of Program Design Features, State Guide, May 31, 2023, Update, Washington, DC: Georgetown University Center for Retirement Initiatives.

The responses to these questions are for general information and not intended as legal advice. Federal and state law and program terms should be carefully reviewed before taking any action.

[ Back to top ]

Auto-IRA Common Program Design Features

What is the most common default contribution rate?

5% of taxable wages

Do state programs use auto-escalation in addition to auto-enrollment?

Yes, several of the open programs — including CalSavers, Illinois Secure Choice, and OregonSaves — use auto-escalation. It is most commonly an annual increase of 1% up to a cap of between 8 and 10 percent. The OregonSaves program has used annual auto-escalation since January 2019.

What type of IRA can a state program use?

A state program can use either a Roth or traditional IRA. Most state programs use a Roth IRA as the default savings vehicle, although they also make the traditional IRA available.

Why do state programs often use the Roth IRA as the default instead of the traditional IRA?

Generally, someone expecting to be in a higher tax bracket at the time of retirement is financially better off by contributing to a Roth IRA than a traditional IRA, because distributions from a Roth IRA at the time of retirement will not be taxed. Beyond potential tax benefits, Roth IRAs have the advantage of not requiring minimum distributions at age 72. From an administrative perspective, a Roth IRA also makes it easier to process a participant’s “do-over” request to dis-enroll after participating for only a few pay periods, because the return of contributions is non-taxable and penalty-free. (Return of any investment income — likely to be small — would be taxable, and probably subject to the 10% early withdrawal penalty.)

States using a Roth IRA as the default will have no way of knowing whether a participant will exceed the Roth IRA income limit for the year. Contributions that exceed the income limit are hit with a 6% excise tax unless withdrawn by the individual’s income tax filing deadline. (The 6% tax is imposed annually until corrected.) Thus, state program communications should clearly inform participants of the earnings limit and correction rules for Roth and/or traditional IRAs.

Although there are strong reasons for using a Roth as the default, states should consider allowing participants to elect a traditional IRA, either because they earn too much for a Roth IRA or the traditional version meets personal retirement or tax planning objectives. The Roth IRA is often the selected default contribution option because many savers have low-to-moderate income and are less likely to benefit from the traditional IRA tax deduction. More conditions also allow for withdrawals from a Roth IRA without penalty.

Is there a common set of investment options offered?

Many state programs offer a simplified set of investment options for easy decision-making. The default investment option is often a target date fund (TDF). In addition to the default investment option, programs commonly offer a capital preservation fund, a growth fund, and a fixed income fund.

For more information:

State-Facilitated Retirement Savings Programs: A Snapshot of Program Design Features, State Guide, May 31, 2023, Update, Washington, DC: Georgetown University Center for Retirement Initiatives.

The responses to these questions are for general information and not intended as legal advice. Federal and state law and program terms should be carefully reviewed before taking any action.

[ Back to top ]

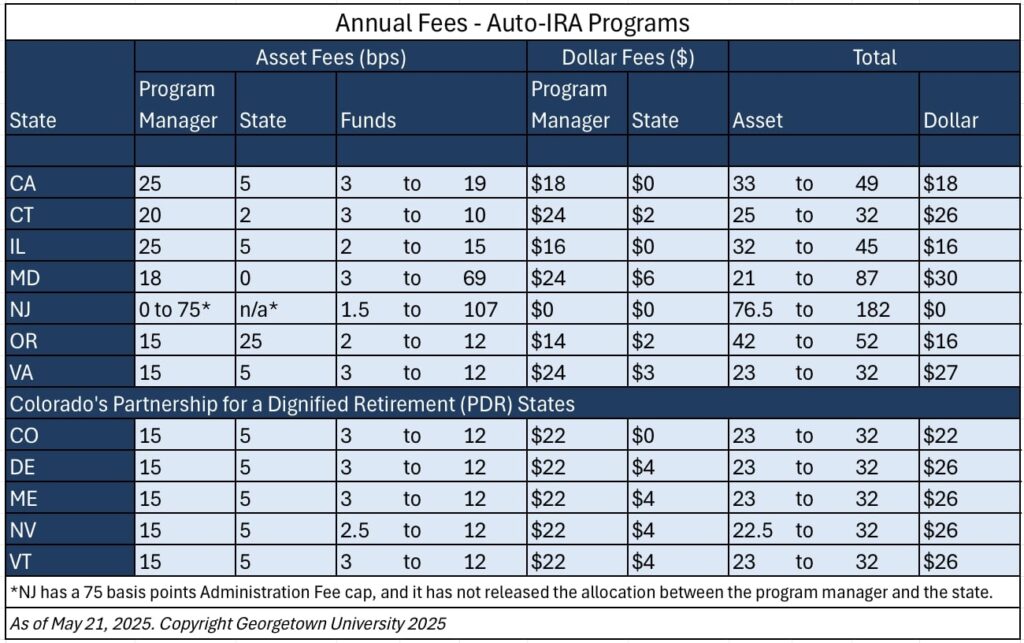

Fee Structures Across State Programs

What are the types and amounts of program fees?

Auto-IRA Programs:

Auto-IRA plans in Oregon, California, and Illinois initially all began exclusively relying on asset-based fees to cover program administration and state costs. The state program share of these fees were very low with most of the fees charged to support the program administrator (AKF Consulting Market Report, 2021).

However, in late 2021 Oregon (OregonSaves) changed its program administrator and took the opportunity to modify its existing fee structure to adopt a hybrid fee-based structure—utilizing dollar-based fees as well as asset-based fees. Oregon later announced additional adjustments to its fee structure in November 2022, still maintaining a hybrid structure but reducing its dollar-based fees.

Connecticut (MyCTSavings), Maryland (Maryland$aves), Colorado (Colorado Secure Savings), and Virginia (RetirePath VA) learned from the OregonSaves experience and implemented a hybrid-fee model at pilot/program launch. California (CalSavers) subsequently transitioned to include dollar-based fees in June of 2023, and Illinois Secure Choice is adopted a hybrid fee structure effective the first quarter of 2024.

While asset-based fees are sufficient to cover expenses for the underlying investment funds, Auto-IRA programs have learned much more about what they need to fund the operating costs of the state and the program administrator. A hybrid fee-based structure more effectively supports these needs. Private sector program administrators prefer dollar-based fees when programs have not yet reached critical mass to produce a more reliable revenue stream and while asset-based fees do not yet generate sufficient operating revenue. (AKF Consulting Market Report, 2022). Furthermore, dollar-based fees are viewed as cost-effective for participants in the long run as accounts grow.

Multiple Employer Plans (MEPs):

Multiple Employer Plans (MEPs):

The only currently active MEP plan is Massachusetts CORE MEP. For the participant, there is a $65 annual fee, deducted automatically from the participant’s account, and other administrative fees depending on the “elective Plan features used by a participant. Each investment option has an administrative, advisory, and investment management fee that varies by investment option” and “additional fees, including administrative and other service fees, may be assessed over time.” For the participating nonprofit, there is a one-time installation fee of $2,500, a $200 plan administrative fee charged annually beginning in the second year, and an annual compliance fee of $150 for employer contribution election and $750 for deferral-only election

The “My Total Retirement” advisory service allows participants to receive custom portfolio management for a scaling percent fee, starting at 45 bps for the first $100,000, and shrinking for every $150,000 increment to a 15 bp fee for any amount over $400,000.

For more information:

Massachusetts CORE MEP program brochure

State-Facilitated Retirement Savings Programs: A Snapshot of Program Design Features, State Guide, May 31, 2023, Update, Washington, DC: Georgetown University Center for Retirement Initiatives.

[ Back to top ]

Positive Impact of State Programs on Private Employer-Sponsored Plan Formation

What impact does a state-facilitated retirement savings program have on employer-sponsored retirement plans in that state?

According to studies by the Pew Charitable Trusts that examined Form 5500 annual filings by employer-sponsored plans from 2013 to 2019, to the U.S. Department of Labor, in states with auto-IRA programs, “employers with plans continue to offer them and businesses without plans are adopting new ones at rates similar to before the state options were available.” Pew updated this analysis more recently and looked at 2021 Form 5500 (F5500) data. The data confirms that state-facilitated retirement savings program complement, rather than compete with, employer-sponsored plans.

Pew found that in 2021, “the rate of introduction of new plans, as a share of existing plans, remained higher than before each introduced its savings program” in California, Oregon, and Illinois. Additionally, the rates at which existing plans were terminated were “below the rate for the nation as a whole” in these three states.

As Pew concludes, the “evidence from California, Oregon, and Illinois continues to indicate that auto-IRAs complement the private sector market for retirement plans such as employer-sponsored 401(k)s.” Indeed, in these states, the data may ultimately show that plan providers appear to be benefiting from the new market opportunities created by such state programs.

A study conducted by the National Bureau of Economic Research (NBER), using data from the Current Population Survey (CPS) and Form 5500 filings, examined the impact of state auto-IRA legislation on employee-sponsored retirement plans (ESRPs) and employee participation. The data indicated that “auto-IRA legislation has a positive impact on the likelihood of employers offering retirement plans and individuals participating in these plans.”

NBER found that individuals are 3.2 percent “more likely to work for an employer who offers a retirement plan after auto-IRA policy implementation” in states where auto-IRA legislation has passed, and that the likelihood of worker participation in these plans increases by 7 percent. Furthermore, firms in states with auto-IRA programs are 1.5 – 1.7 percent are more likely to offer any kind of employee-sponsored retirement plan than those without these programs. The data indicates that “worker participation in existing retirement plans rises by 3 – 5 percent” in program states.

The NBER study concludes that “auto-IRA policies significantly increase the likelihood of employers offering ESRPs, employee access to these plans, and participant numbers in existing ESRPs.”

For more information:

Source: Guzoto, Theron, Hines, Mark, and Shelton, Alison. (July 25, 2022). State Auto-IRAs Continue to Complement Private Market for Retirement Plans. Philadelphia, PA: Pew Charitable Trusts.

Guzoto, Theron, Hines, Mark, and Shelton, Alison. (April 14, 2023). State Automated Retirement Savings Programs Continue to Complement Private Market Plans. Philadelphia, PA: Pew Charitable Trusts.

Bloomfield, Adam, Lee, Kyung Min, Philbrick, Jay, and Slavov, Sita, “How Do Firms Respond to State Retirement Plan Mandates?” NBER Working Paper 31398, National Bureau of Economic Research, Inc., 2023.

[ Back to top ]

Employer and Employee Program Experience

How do employers surveyed view their experience with the OregonSaves program?

According to surveys conducted by the Pew Charitable Trusts, employers reported the following:

- About 80 percent of OregonSaves employers did not report any out-of-pocket costs with the program.

- 80 percent of participating firms in OregonSaves reported no or few employee questions or concerns.

- 73 percent of employers surveyed reported they were either satisfied with or neutral about their program experience.

Sources: Scott, John and Hines, Mark. (May 2021). Is the OregonSaves Retirement Program Expensive for Employers?; (March 2021). OregonSaves Auto-IRA Program Elicits Few Questions from Employees; and (July 2020). Employers Express Satisfaction With New Oregon Retirement Savings Program. Philadelphia, PA: Pew Charitable Trusts.

How do employees surveyed view their experience with the Illinois Secure Choice program?

In a survey conducted by the Pew Charitable Trusts, workers reported the following:

- Almost 40 percent reported that the program made them feel more financially secure.

- Approximately 60 percent were either very satisfied or satisfied with their program experience, and 96% were neutral or satisfied.

- More than two-thirds reported that they trusted information from the Illinois Secure Choice Program.

Source: Scott, John and Hines, Mark. (April 18, 2022). Many in Illinois Retirement Savings Program Feel Their Financial Security Is Improving. Philadelphia, PA: Pew Charitable Trusts.

[ Back to top ]

Comparison of the Basic Features of an IRA vs. a 401(k)

What are the differences between IRAs and 401(k)s?

| State Auto-IRA | 401(k)/DC | |

| ERISA Regulation | Non-ERISA | ERISA |

| Administrative Simplicity | Yes | Somewhat (single plans vs. MEP/PEP affects burden on employers) |

| Contributions Allowed | Employee pre-tax/Roth | Employee pre-tax/Roth and employer |

| Investments | Employee chooses from plan “menu,” including a pooled and professionally managed option and/or private sector (third-party) options | Employee chooses from plan “menu,” including a pooled and professionally managed option and/or private sector (third-party) options |

| Employers Required to Adopt | Yes, under current law | Unlikely |

| Auto-enrollment with Employee Opt-Out | Yes | Yes |

| Pros |

|

|

| Cons |

|

|

Source: Morse, David and Antonelli, Angela. (March 2021). State-Facilitated Retirement Savings Programs: A Policymaker’s Guide to ERISA and the Tax Code, Table A, p. 2. Washington, DC: Georgetown University Center for Retirement Initiatives.

The responses to these questions are for general information and not intended as legal advice. Federal and state law and program terms should be carefully reviewed before taking any action.

[ Back to top ]

A Comparison of Traditional IRAs and Roth IRAs

What are the differences between a Traditional IRA and a Roth IRA?

Traditional IRAs |

Roth IRAs |

|

| Eligibility | Individual must have a salary, self-employment earnings, or other taxable compensation.

There is no age maximum. |

Same as traditional, and individual (plus spouse if married, filing a joint return) must have modified adjusted gross income (MAGI) below specified limits. For 2024, the limits are as follows.

Single filer with MAGI of:

Joint filers with MAGI of:

|

| Deductible Contributions | For 2024:

Contributions are tax-deductible if individual (and spouse) is not covered by a 401(k) or other retirement plan. Contributions come out of employee paychecks pre-tax and are instead taxed on distribution at retirement. If covered by a retirement plan, contributions are deductible only if income is below certain limits. For 2024: Single filer, covered by a retirement plan at work, with MAGI of:

Joint filer, covered by a plan at work, with MAGI of:

|

Roth contributions are not tax-deductible. |

| Federal Income Tax Treatment on Contributions and Earnings | Earnings grow tax-deferred until distributions begin. Distributions are taxed as ordinary income. Withdrawals of nondeductible contributions are not taxed. | Withdrawals of contributions are not taxed. Qualified distributions are tax-free.

Earnings on nonqualified distributions earnings are taxed as ordinary income and may be subject to a penalty. |

| Penalties on “Early” and “Late” Distributions | Distributions from contributions and earnings can be taken after age 59½ without a federal tax penalty.

Required minimum withdrawals (RMDs) (based on life expectancy) must begin by age 73. Late distributions are subject to 50% excise tax. Distributions before age 59½ are subject to a 10% penalty tax unless certain exceptions are met, including:

|

Distributions from earnings are tax-free if the initial contribution to the IRA was made at least five years ago and the individual is:

Payments made to beneficiaries after the five-year period are also tax- and penalty-free. Payments made before the end of the five-year period are penalty-free. Distributions from earnings are not subject to the 10% penalty if they qualify for an exception — the same as exceptions for traditional IRAs. |

Source: Morse, David and Antonelli, Angela. (March 2021). State-Facilitated Retirement Savings Programs: A Policymaker’s Guide to ERISA and the Tax Code, Table B, p. 7. Washington, DC: Georgetown University Center for Retirement Initiatives.

The responses to these questions are for general information and not intended as legal advice. Federal and state law and program terms should be carefully reviewed before taking any action.

[ Back to top ]

Vendors Servicing State-Facilitated Retirement Savings Programs

Who are the vendors servicing state-facilitating state retirement programs?

Auto-IRA Programs

Minnesota:

Projected launch: between January 1, 2026 and March 30, 2026

- Program Consultant: AKF Consulting

New York:

Projected launch: mid-2025

- Program Consultant: AKF Consulting

- Program Administrator: Vestwell

- Investment Management: State Street Global and BlackRock

Nevada:

Program launched: June 17, 2025

- Program Administration: Vestwell, in partnership with BNY Mellon (CO Partnership)

- Program Consultant: AKF Consulting

- Investment Consultant: Meketa

- Investment Management: State Street Global and BlackRock (CO Partnership)

Vermont:

Program launch: December 1, 2024

- Program Administration: Vestwell, in partnership with BNY Mellon (CO Partnership)

- Investment Consultant: RVK

- Investment Management: State Street Global and BlackRock (CO Partnership)

- Program Branding Consultant: Place Creative Company

Delaware:

Program launch: July 1, 2024

- Marketing Firm: Aloysius Butler & Clark (AB&C)

- Program Consultant: AKF Consulting

- Program Administration: Vestwell, in partnership with BNY Mellon (CO Partnership)

- Investment Management: State Street Global and BlackRock (CO Partnership)

New Jersey:

Program launch: June 30, 2024

- Program Administration: Vestwell

- Marketing Consultant: Marketsmith Inc.

- Investment Advisor: Segal Marco Advisors

Maine:

Program launch: January 27, 2024

- Program Administration: Vestwell, in partnership with BNY Mellon (CO Partnership)

- Investment Consultant: Meketa

- Investment Management: State Street Global and BlackRock (CO Partnership)

- Branding Consultant: Visual Logic

- Legal Counsel: K&L Gates

Virginia:

Program launch: June 20, 2023

- Program Consultant: AKF Consulting

- Program Administration: Vestwell

- Investment Consultant: Mercer

- Investment Management: BlackRock

Colorado:

Program launch: January 18, 2023

- Program Consultant: AKF Consulting

- Program Administration: Vestwell, in partnership with BNY Mellon (CO Partnership)

- Investment Consultant: Segal Marco

- Investment Management: State Street Global and BlackRock

Maryland:

Program launch: September 15, 2022

- Program Consultant: AKF Consulting

- Program Administration: Vestwell

- Investment Consultant: AonHewitt

- Investment Management: BlackRock, State Street Global Advisors (SSGA), Lincoln Financial Group, and T. Rowe Price

Connecticut:

Program launch: April 1, 2022

- Program Consultant: AKF Consulting

- Program Administrator: Vestwell

- Investment Consultant: Segal Marco

- Investment Management: Lockwood Advisors (a BNY Mellon subsidiary) as Investment Advisor; Investment Managers – Fidelity, Schwab, and Vanguard

California:

Program launch: July 2019

- Program Consultant: AKF Consulting

- Program Administrator: Ascensus

- Investment Consultant: Meketa Investment Group

- Investment Funds Management: SSGA and Calvert Research and Management (ESG only)

Illinois:

Program launch: October 2018

- Program Consultant: AKF Consulting

- Program Administration: Ascensus

- Investment Consultant: Marquette Associates

- Investment Funds Management: BlackRock, Charles Schwab, SSGA

Oregon:

Program launch: October 1, 2017

- Program Administration: Vestwell

- Investment Consultant: Sellwood Consulting

- Investment Funds Management: SSGA

Multiple Employer Plans (MEPs)

Massachusetts CORE Program:

Program launch: October 27, 2017

- Program Administration: Empower Retirement

- Investment Consultant and ERISA Fiduciary: AonHewitt

- ERISA Fiduciary Administrative Services: Northeast Professional Planning Group

Marketplace

New Mexico Work & $ave

This program has been put on indefinite hold with no known new implementation date. These contracts have likely expired.

- Program Consultant: AKF Consulting

- Marketplace Consultant: Massena Associates

- Strategic Planning and Communications Consultant: Carroll Strategies LLC

Washington Small Business Retirement Marketplace:

Program launch: March 19, 2018

- IRA products: Aspire Capital Advisors; previously also provided by Finhabits

- 401(k) products: none currently; previously provided by Saturna which exited in January 2022

Other program states will be added as they enter contracts with vendors.

This list is as of July 9, 2025 and will be updated periodically.

Source: Georgetown University Center for Retirement Initiatives compiled from state and public sources. Use of this list and this information collected by the Center should be attributed to the Center.

[ Back to top ]