State Program Performance Data – Current Year

State Program Data & Trends

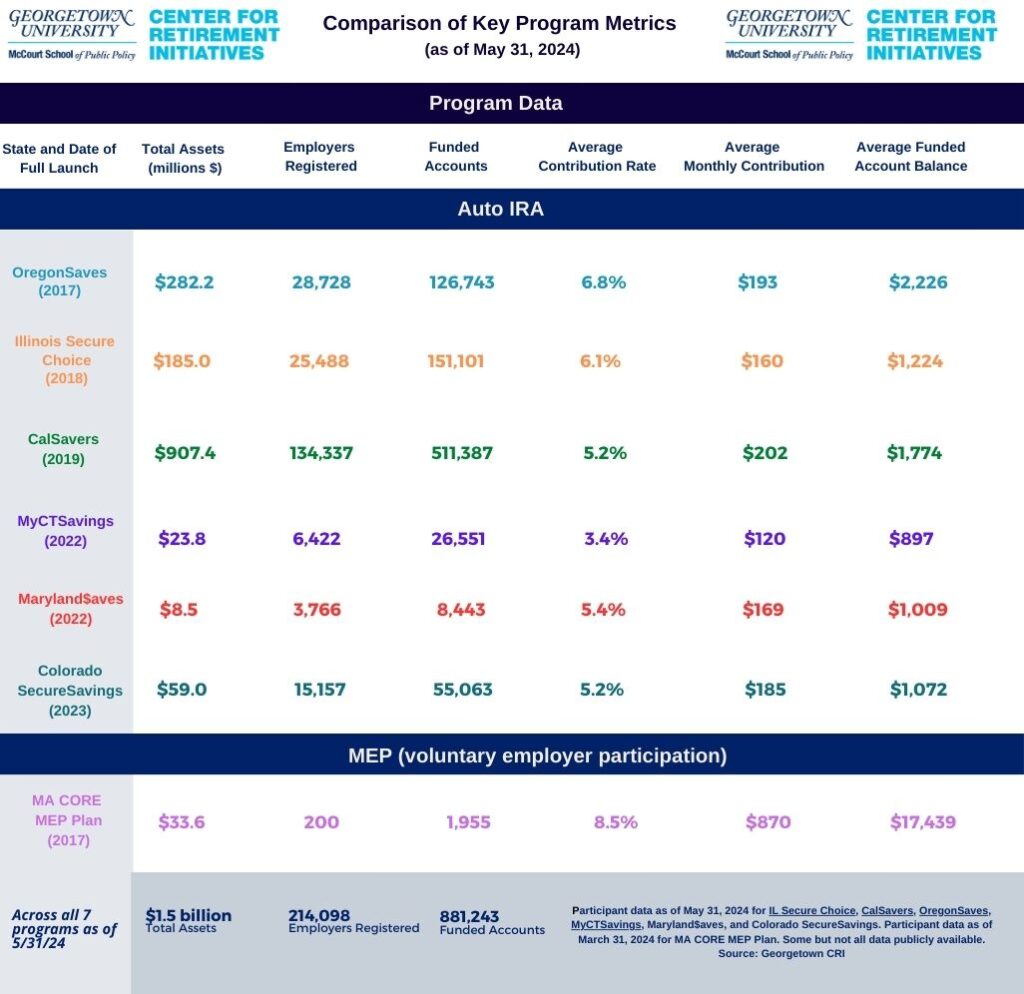

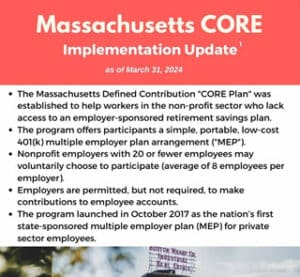

Sources of Data: CalSavers, Colorado SecureSavings Program, Illinois Secure Choice Retirement Savings Program, MyCTSavings, Maryland$aves, OregonSaves, the Massachusetts CORE program, and Washington’s Department of Commerce. Some state program data is not publicly available but collected by the CRI. Proper attribution to the Georgetown University Center for Retirement Initiatives should be made when using the information and data collected, aggregated, and analyzed by Georgetown.

Note: Select metrics may not be available for all state programs. Select Y/Y Growth Metrics may be available for MyCTSavings, Maryland$aves, and the Colorado SecureSavings Program and in certain instances for other state programs. MyCTSavings opened to all eligible employers in April 2022, Maryland$aves opened to all eligible employers in September 2022, and the Colorado SecureSavings Program opened in January 2023. By comparison, CalSavers, Illinois Secure Choice, and OregonSaves have been open for several years (see additional information provided on this page).

Other State Program Specific Data

State Performance Data and Reports

If you are interested in specific data and/or analysis of performance trends for state programs, including performance indicators not displayed on this site, contact Angela Antonelli at crietirement@georgetown.edu or call 202-687-4901. View archive of past monthly performance reports (log in required).