State Auto IRA Policies Have Expanded the Market for Retirement Plans

By Manita Rao and Adam Bloomfield

Although estimates vary, up to half of working adults do not have access to a workplace retirement plan at a given time, which makes saving for retirement more challenging. Research has shown that numerous concerns inhibit workers from saving for retirement and that easing these barriers can help individuals increase their long-term savings. In recent years, many states have passed legislation and initiated retirement savings programs to help close the coverage gap. State-facilitated automatic enrollment Individual Retirement Account (Auto IRA) programs provide workers with an opportunity to save for retirement through payroll deduction, which is a common and straightforward way to periodically put money aside for long-term financial security. However, new evidence shows that these state policies also induce employers to establish their own retirement plans.

Our new study documents this latter and less expected effect of the state-facilitated retirement savings programs — an expansion in the private market for retirement plans. Research that we co-authored with Lucas Goodman, a financial economist with the U.S. Department of the Treasury, and Sita Slavov, a professor of public policy at George Mason University, finds that recent state policies requiring employers to facilitate workplace savings options have induced at least 30,000 firms to establish retirement plans. This indicates that states that have implemented Auto IRA legislation have seen an expansion in the retirement plan market for smaller employers and reduction in the retirement plan coverage gap among workers.

The study also documents that firms induced to establish retirement plans differ from those that offered such benefits before the policies. For example, the induced firms tend to employ younger, Hispanic, and lower-income employees, which suggests that these policies are closing the coverage cap particularly among workers that have disproportionately lacked access to the retirement savings ecosystem.

Research Objectives, Data, and Methods

The objective of the research study was to understand how state Auto IRA policies, which required employers to offer a retirement savings option via payroll deduction and automatic enrollment, affect employer decisions to offer retirement benefits and worker access to such plans. This is an important question because workers who do not have access to a workplace retirement plan are disproportionately employed by small and mid-sized employers that may find it difficult to offer such plans due to cost and administrative constraints.

Therefore, for the legislation to be effective in achieving its goals, it is necessary for small and mid-sized employers to have access to retirement plan options that are sufficiently affordable yet desirable for workers to participate in. To ensure that such an option was available, each state that adopted Auto IRA legislation also established a low-cost state-facilitated savings option. These state-facilitated programs allow employers that do not offer a retirement plan to facilitate worker savings from payroll into IRAs in an easy and flexible way.

One might expect that the introduction of a low-cost option could lead employers to shift away from higher-cost alternatives unless private retirement plan providers make options available that are equally affordable as the state programs and thus satisfy the cost concerns of small and mid-sized employers. However, the study finds the opposite: Employers increase their propensity to offer their own private retirement plans.

Our research study investigates this question by using granular tax data about employers, workers, and retirement plan contributions, which is accessible to staff at the U.S. Department of Treasury. More specifically, we used data for the study from several federal tax forms, including Forms W-2, 1040, 1120S, 941, and 1065. Using this rich data covering the years 2012–2023, in conjunction with advanced econometric methods, the study sheds light on the impact of Auto IRA legislation in the first four states that implemented these policies — California, Oregon, Illinois, and Connecticut — and on employer choices to provide retirement savings plans. The rollout of Auto IRA mandate deadlines by state and firm size allowed the researchers to identify effects caused by the policies by comparing “treated” firms to “control” firms.

Research Findings

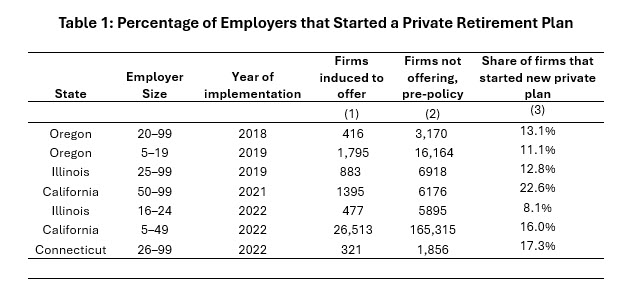

Table 1 presents results from analysis on the share of small and mid-sized employers (those with fewer than 100 employees) that started a new private retirement plan after policy implementation relative to the share of firms that did not offer such a plan before the relevant policy deadline. The share of employers that established a new workplace retirement savings plan ranges from 8 percent in Illinois for firms with 16 to 24 employees to 23 percent in California among firms with 50 to 99 employees. It is pertinent to note that the research finds that the private retirement plan market has expanded substantially in all four states and among all firm sizes. These results show that employees of even very small firms — those with five workers — now have access to retirement savings options in the workplace.

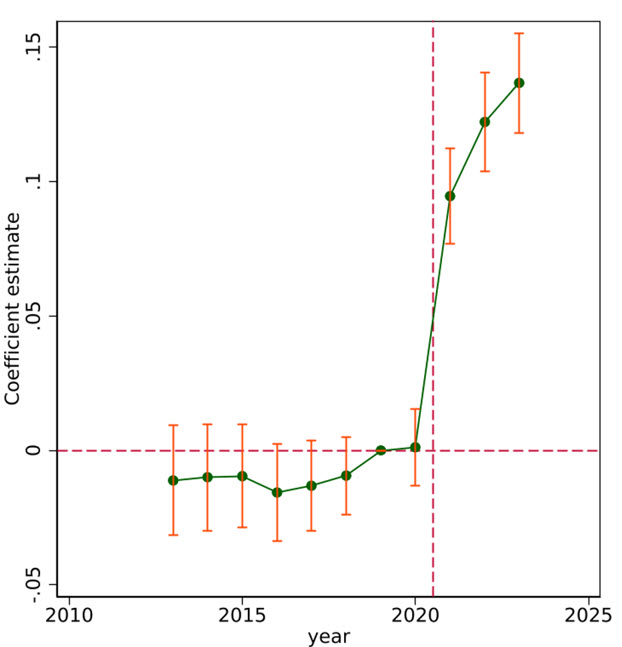

Figure 1 plots the effect of the policy in California on employers offering retirement plans. As observed, Auto IRA policies had an immediate and sustained effect on new plan formation. Many small and mid-sized employers responded to the policies by sponsoring new privately managed workplace retirement plans that provide employees with a payroll deduction savings option.

Figure 1: Increase in Retirement Plans among Employers in California with 50–99 Employees

Conclusion and Policy Insights

Retirement savings are of growing importance to the long-term financial wellbeing of individuals and families, and the source of a large and increasing share of household income during retirement. Having access to affordable and administratively simple ways to save for retirement is an important step toward securing long-term financial stability for U.S. households. The research described in this blog post shows that state retirement policies are reducing the worker coverage gap by increasing the prevalence of employer retirement plans. These empirical findings should be considered by policy makers who are focused on helping Americans achieve a financially secure future.

Manita Rao is a Senior Strategic Policy Advisor, AARP Public Policy Institute, and Non-Resident Fellow, Center for Retirement Initiatives, Georgetown University.

Adam Bloomfield is a Senior Economic Policy Advisor, U.S. Federal Deposit Insurance Corporation, and Non-Resident Fellow, Center for Retirement Initiatives, Georgetown University

September 2024, 24-06

Additional Resources

Doonan, Dan, & Kenneally, Kelly, “Retirement Insecurity 2024: Americans’ Views of Retirement,” National Institute on Retirement Security, February 2024.

Dolls, M., Doerrenberg, P., Peichl, A., & Stichnoth, H. Do Retirement Savings Increase in Response to Information about Retirement and Expected Pensions? Journal of Public Economics 158, 168–179, 2018.