Delayed Claiming of Social Security Retirement Benefits: Almost a Free Lunch?

By David Blanchett

Relatively few retirement income planning strategies are more highly regarded among retirement researchers than delayed claiming of Social Security retirement benefits. Not only are Social Security retirement benefits explicitly linked to inflation — something no other lifetime income annuity offers today, but Social Security retirement benefits are also tax-advantaged and can provide attractive spousal survivor benefits. Couple these traits with a benefit formula that is based on outdated mortality assumptions and the benefits associated with delayed claiming seem pretty obvious (almost a free lunch!).

Potential Benefits of Delayed Claiming

I recently tackled the potential benefits of delayed claiming in research focused specifically on the benefits from a defined contribution (DC) plan perspective. DC plans have become the overwhelming favorite retirement savings plan among employers, so educating participants (and employees) about the benefits of delaying, as well as providing them with advice and guidance to make optimal decisions, has the potential to materially improve retirement outcomes with relatively low cost or commitment from the plan sponsor (i.e., employer).

My research indicates that the breakeven return required to outperform delayed claiming would generally exceed 10% for the life of the retiree, which is a relatively high hurdle and significantly riskier than the guaranteed nature of Social Security retirement benefits.

The DC plan community has also shown a notable increased interest in longevity-protected solutions, like income annuities. While some (or many) of these solutions have the potential to create better retirement outcomes for DC plan participants, it is especially important to ensure that participants (and employees in general) have considered delayed claiming before purchasing an annuity, given its relative benefits.

A trio of researchers, including Laurence Kotlikoff, also recently released research exploring the benefits of delayed claiming. Relying primarily on data from the 2019 Survey of Consumer Finance (SCF) and employing a relatively complex lifecycle model, they found that delayed claiming is the optimal choice for the vast majority of Americans. While they suggest more than 90% of Americans should delay claiming until age 70, however, only around 10% do so today. The estimated loss from early claiming for those who could benefit from doing so is relatively significant, with a median present value loss of spending at approximately $180,000 and median loss among all households closer to $115,000.

While I could quibble with some of the assumptions (e.g., the assumed retirement period is relatively conservative, using a maximum longevity age of 100), the overall message that most, if not all, people who have the financial means to delay claiming benefits should do so is one that should be repeated as often as possible. Many retirees simply aren’t going to have the means to delay claiming (and potentially shouldn’t, depending on things like expected longevity), but reiterating the benefits of delayed claiming is especially important given the clear behavioral barriers associated with doing so.

Why Aren’t More People Delaying?

So why aren’t more people delaying? There are a variety of potential drivers here, including a lack of understanding of the benefits of delaying, lack of resources to afford to delay (which I explore further in my research), and concern about the security of the trust fund (which is currently projected to be depleted in 2033), among others. While each of these is a viable reason to claim early, providing participants access to materials that address these points, and potentially to a financial advisor to specifically address them, is one possible way to improve claiming decisions.

Determining an appropriate spending rate from accumulated savings is incredibly complex when faced with uncertain longevity and portfolio returns. Pension systems, such as Social Security retirement benefits, radically simplify the retirement income generation process and can provide benefits to retirees that are both economic (i.e., generate more income than self-annuitizing) and behavioral (i.e., give retirees the ability to be more comfortable with consuming, or a “license to spend,” as I’ve noted in some research with Michael Finke and has been previously highlighted by the Georgetown CRI).

Ways to Encourage Delayed Claiming

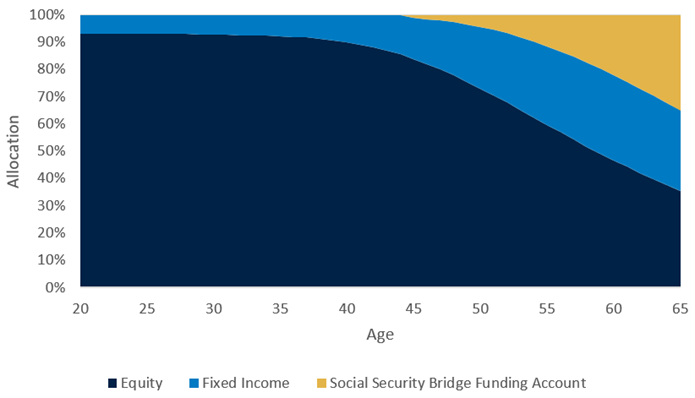

One potential approach to encourage delayed claiming among savers would be to create an explicit “sleeve” within the plan default investment, which is typically a target-date fund (TDF) but could also be a managed account. It would be specifically allocated with the understanding that those funds would be used to “bridge” the period from retirement to delayed claiming.

This could be an intentional way to precondition DC participants to delay. In theory, the pool of savings could be allocated to other potential retirement income solutions (e.g., an income annuity) that could make more sense based on specific preferences and situations of participants or households.

A hypothetical example of how this could work can be found in this exhibit:

Allocating Savings to Fund Delayed Claiming with an Explicit Bridge Account

Chart shown for illustrative purposes only and subject to change.

Conclusion

A relatively large and growing body of research suggests that retirees should actively consider delaying claiming Social Security retirement benefits. As far as retirement income strategies go, that is probably the closest thing to a free lunch that exists today. Therefore, the DC industry should take a more active role in communicating these benefits to help more Americans achieve a better retirement.

David Blanchett is Managing Director and Head of Retirement Research at PGIM DC Solutions.

PGIM is a supporter of the Georgetown University Center for Retirement Initiatives (CRI). The views expressed are those of the authors and do not represent the views of the CRI.

March 2023, 23-02

Additional Resources

Altig, David, Kotlikoff, Laurence J., and Ye, Victor Yifan, How Much Lifetime Social Security Benefits Are Americans Leaving on the Table? November 16, 2022.

Blanchett, David, Delaying Social Security Retirement Benefits: The Bridge to Better Outcomes in Defined Contribution Plans? SSRN. December 22, 2022.

Blanchett, David, and Finke, Michael, Guaranteed Income: A License to Spend. SSRN. July 13, 2021.