How Universal Access and a Refundable Saver’s Tax Credit Can Transform Retirement Savings

By Anna Milstein and Angela Antonelli

Expanding access to retirement savings options would give low- and moderate-income workers the opportunity to generate meaningful savings by the end of their careers. By beginning to save and starting sooner, private sector workers can take advantage of compounding interest investment returns. That, especially if supplemented by other incentives such as a refundable Saver’s Tax Credit, would result in significantly improved retirement income outcomes compared to workers who begin saving later in their careers.

A recent study conducted by the Georgetown University Center for Retirement Initiatives (CRI) examined the differences in savings and retirement income for three scenarios, modeled using an auto-IRA program similar to state-facilitated retirement programs in California, Illinois, and Oregon: a young saver, a mid-career saver, and an older saver.

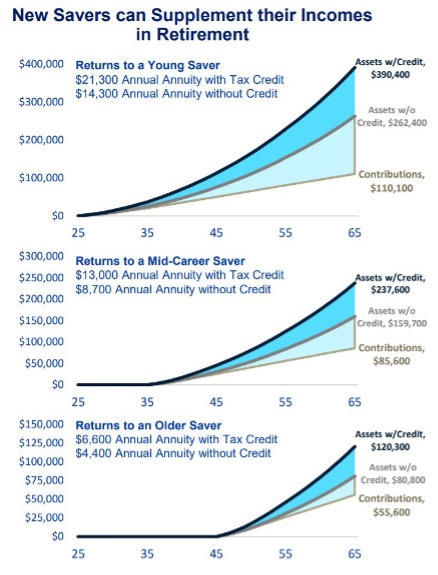

As seen in this chart, the “young saver” started their account at age 25 and earned an average salary at a small employer over a 40-year career. The “mid-career saver” started saving at age 35 and earned an average salary over the remaining 30 years of their career. The “older saver” started saving at age 45 and earned an average salary over the remaining 20 years of their career.

As seen in this chart, the “young saver” started their account at age 25 and earned an average salary at a small employer over a 40-year career. The “mid-career saver” started saving at age 35 and earned an average salary over the remaining 30 years of their career. The “older saver” started saving at age 45 and earned an average salary over the remaining 20 years of their career.

While older savers are still able to accumulate some retirement assets, they are unable to benefit from the years of compounding returns available to younger savers. An analysis of total contributions, rate of return on those contributions, assets at retirement, and annual annuity amounts supported by these assets for each representative saving scenario reveals the impact of saving early and consistently for retirement.

A young (25-year-old) saver with a salary of $35,000 per year could see their account balance grow to more than $262,000 in assets by making contributions of approximately $110,000 over a 40-year period. Using this lump sum to purchase an immediate fixed annuity at the age of 65 would then generate an annual supplemental income of $14,300 per year over the remainder of the saver’s lifetime. However, the older saver, who began saving at age 45 while making the same salary and contributed at the default level for 20 years, would see their account grow to $80,800 in assets from $55,600 in contributions. These assets could be used to purchase a fixed annuity at 65, but this annuity would only add $4,400 in supplemental income over the rest of the older saver’s lifetime.

These results emphasize the power of time and compound interest on savings and retirement security.

The Impact of the Saver’s Tax Credit

While many employers make matching contributions to boost savings for their employees who participate in employer-sponsored retirement plans, low- and moderate-income savers too often are not aware that they also can boost their savings by taking advantage of the Saver’s Tax Credit (“Saver’s Credit”). The Saver’s Credit offsets federal tax liabilities up to 50% of contribution levels for qualifying low- and moderate-income savers, but it is not currently refundable, so it can only be used to reduce outstanding taxes. In short, the Saver’s Credit does not function like an employer “match” for low- and middle-income workers — but a refundable tax credit would.

In the analysis of the three distinct savers detailed above, a refundable Saver’s Credit would play a pivotal role in enhancing the assets of each saver — the younger, middle-aged, and older worker — assuming the refundable credit could be deposited into the saver’s retirement account. For the young saver, the refundable Saver’s Credit would increase their return on investment from 138% to 255% and grow their expected annual annuity from $14,300 to $21,300. As the chart shows, with the Saver’s Credit, the younger saver’s total assets would increase from $262,400 to $390,400. The impact of the Saver’s Credit would have the same positive impact when applied to both the mid-career saver and the older saver.

The Importance of Saving Early

Compound interest and the passage of time greatly augment the return on initial contributions for those who begin to save earlier in their careers. Even if savers are unable to contribute regularly to their accounts for a period of time, their existing savings will still benefit the effect of compounding interest returns on early contributions.

To isolate the impact of saving early, the CRI study compared two households with identical earnings — $35,000 per year — and identical contributions of around $54,000 augmented by the Saver’s Credit made over 20 years beginning at different points over a 40-year career. In this analysis, the “early saver” contributed between the ages of 25 and 45 and then stopped saving. The “late saver” contributed from ages 45 and 65, while making an identical contribution amount over the same period as the early saver. Despite contributing the same amount over an identical number of years, the early saver’s assets grew to $282,000, which could be used to purchase an annuity capable of generating around $15,400 in retirement. In contrast, the older saver’s assets totaled $117,000, capable of affording them an annuity worth $6,400 in annual income. By simply saving earlier, the younger saver realized more than double the retirement assets of the older saver.

Universal Access Can Expand Access to More Than 40 Million Workers

Achieving universal access to an Auto-IRA or other retirement option would provide millions of workers with the opportunity to have an easy, straightforward way to save for retirement sooner. Features such as automatic enrollment ensure that workers save consistently and longer. The CRI’s research model estimated how many more workers would be covered with national, universal access to retirement savings. The model assumed a conservative, average opt-out rate of 30% By following a phased implementation from 2024 to 2026, the analysis concluded that more than 35 million workers could be expected to be saving in 2026, to growing to more than 40 million workers by 2040.

Conclusion

Retirement security is achieved through consistent and early saving. Even modest, consistent savings over time can yield considerable accumulation of assets and generate important supplemental income in retirement. However, workers need access to ways to save. In addition, further changes to the Saver’s Credit — most importantly, making it refundable — could increase retirement income by as much as 50%. National, universal access to retirement savings and a refundable Saver’s Credit would create a powerful combination of reforms that would make important progress in strengthening retirement security for millions of American workers.

Anna Milstein is a Research Assistant with the Center for Retirement Initiatives (CRI).

Angela M. Antonelli is a Research Professor and the Executive Director of the Georgetown University Center for Retirement Initiatives (CRI).

August 2021, 21-07

Additional Resources

Antonelli, Angela (2020). What are the Potential Benefits of Universal Access to Retirement Savings? Georgetown University Center for Retirement Initiatives in conjunction with Econsult Solutions, Inc.

Antonelli (2021). State Benefits of Expanding Access to Retirement Savings. Georgetown University Center for Retirement Initiatives in conjunction with Econsult Solutions, Inc.