Retirement Savings in the Time of COVID-19: International Best Practices to Address Challenges

By Pablo Antolin

The COVID-19 pandemic and its related economic downturn are negatively affecting retirement savings, retirement systems, plan sponsors, plan providers, and regulators. The long-term consequences may result in significant market disruptions and lower retirement incomes in the future.

COVID-19 is challenging retirement savings arrangements around the world in several important ways. It has led to:

- A decrease in the value of assets in retirement savings accounts from falling financial markets.

- A lower capability to contribute to retirement savings plans as individuals see their wages reduced or lose their jobs, and as employers suffer financial distress.

- An increase in liabilities from falling interest rates in retirement savings arrangements with retirement income promises (e.g., defined benefits [DB] retirement plans and life annuity arrangements).

- Cyber-attacks, frauds, and scams directed at individuals, regulators, sponsors, and providers of retirement savings schemes (e.g., pension funds).

- Operational disruptions because of working remotely.

Policymakers are trying to respond rapidly to the crises related to COVID-19 and address the same issues, but their responses will depend on their own specific circumstances. Nevertheless, countries can learn and benefit from each other.

Key Recommendations

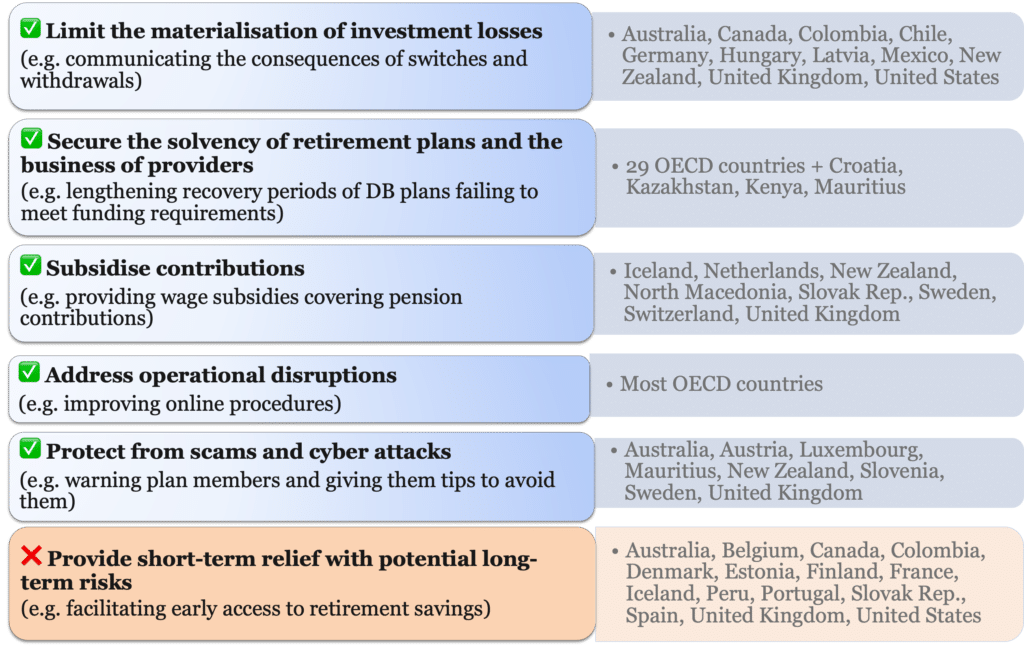

For countries responding with policies to tackle these challenges, the Organization for Economic Co-operation and Development (OECD) has developed a series of key recommendations for policymakers, industry, and stakeholders based on international best practices for the design and regulation of retirement savings arrangements.

Source: OECD, “Retirement Savings in the time of COVID-19,” June 22, 2020, p. 3.

1. Communicate the importance of staying the course and maintaining long-term investment plans to avoid selling and realizing long-term losses in retirement portfolios.

Countries need to communicate the importance of avoiding losses that occur by selling when markets are down. Fluctuations in asset values are inevitable during the life of a retirement portfolio. Over the long term, a portfolio’s investment provides a return on savings for retirement. Experience shows that selling when markets go down and buying when they go up is far from appropriate, because “timing the market” (i.e., attempting to predict future market movements) does not work. Selling assets when shocks occur risks reduction in value and precludes opportunities to recover those losses. It took about two years for most countries that experienced substantial valuation losses during the 2008 financial crisis to recover to 2007 levels. If people do not sell their assets, they are less likely to suffer losses, allowing their portfolios to eventually recover and return to a more-steady growth over the long term. Opportunities to recoup losses are going to be more limited with a shift to more-conservative investments.

2. Emphasize the importance of continuing to contribute to retirement plans.

Countries are adopting measures such as income transfers or income subsidies, such as special unemployment programs and income payments, to help offset reduced working hours or the loss of employment. These measures can help preserve retirement contributions and reduce the need to tap into existing retirement savings.

3. Allow for regulatory flexibility; provide proportionate, flexible, and risk-based supervisory oversight; and make sure that funding and solvency rules are counter-cyclical.

Countries have implemented policies to secure the solvency of plans with benefit guarantees and the business of plan providers. They have allowed for regulatory flexibility to address liability problems tied to falling interest rates, for example, in plans with benefit guarantees. Regulatory rules, including mark-to-market valuation principles and recovery plans, remain essential for the long term but must be flexible during exceptional circumstances. However, it is also important to reverse that flexibility once the exceptional circumstances have faded.

Flexibility with respect to regulatory compliance and supervisory oversight in a proportionate, flexible, and risk-based manner could help alleviate the on-going pressures that could lead to poor decisions or exacerbate the financial difficulties that a plan sponsor faces. Flexibility in regulation and supervisory oversight should focus on making sure that any increase in the liabilities of DB pension plans and insurance companies offering life annuities would not put further strain on those offering retirement income promises during difficult times.

In addition, funding and solvency rules for DB plans should be counter-cyclical to current economic conditions. Introducing flexibility in meeting funding requirements would help to avoid “pro-cyclical policies” and allow pension funds to act as long-term investors and potentially stabilizing forces in the global financial system.

4. Protect providers and participants from scams and frauds.

Countries are increasingly adopting policies to protect plan sponsors, providers and participants from cybersecurity risks and COVID-19 related scams, including disclosures of the type of scams and frauds on the websites of government agencies and retirement savings plan providers. In addition, retirement plan trustees and advisors should be reminded to send regular and clear information to plan members to reduce the likelihood of scammers successfully preying upon people’s misunderstanding of information and fears during a crisis.

5. Avoid policies intended to provide relief in the short term that can have long-term unintended consequences, especially on retirement income adequacy.

Several countries have implemented measures that provide short-term relief but may have lasting negative consequences on retirement well-being. These include measures such as contribution holidays (temporarily exempting employers and individuals from contributing to retirement savings accounts) and access to retirement savings accounts, which may affect the adequacy of future retirement income.

It is important to avoid allowing premature access to balances accumulated to finance retirement as much as possible, especially if access is universal. The goal of retirement plans is to finance retirement. Allowing withdrawals from retirement accounts may lead not only to lower retirement income adequacy but also to losses in asset value, as well as disruptions to liquidity and investment management.

Withdrawing assets from retirement plans should be a measure of last resort, although there can be room for flexibility in exceptional personal circumstances. Most jurisdictions already include provisions allowing for partial withdrawals of retirement savings based on specific exceptional circumstances: hardship situations like unemployment accompanied by protracted and large losses of income, or terminal illnesses. These programs should be maintained for people in the greatest need. The main emergency mechanisms that governments can use, and may want to continue to use, to assist people with such large temporary losses in income, are unemployment programs. Access to retirement savings should remain an exceptional measure based on individual specific circumstances as defined in regulations.

6. Address the risk of disruptions to ensure the continuity of operations.

Policymakers, regulators, plan sponsors, and pension funds in many countries have been learning quickly about how to address the operational disruptions that come with a need to work remotely. They are developing and implementing business continuity plans and adapting their processes (e.g., collecting and remitting contributions, facilitating enrollment and reporting, etc.), as needed, to accommodate teleworking.

Conclusion

The pandemic has presented new, unprecedented challenges for the retirement industry. Policymakers, regulators, plan sponsors, and providers must work together to address these challenges. Close cooperation among all stakeholders at the national and international levels, including sharing lessons learned and best practices, will help in the development of new solutions and effective ways to deal with the current and any future crisis.

Pablo Antolin is the Principal Economist and Head of the Private Pensions Unit, and the Deputy Head of the Insurance, Pensions, and Financial Markets Division, of the OECD. He also serves as a member of the Georgetown University Center for Retirement Initiatives Council of Scholar Advisors.

July 2020, 20-08

Additional Resources

Defined Contribution Institutional Investment Association (DCIIA), “Initial Impacts of Coronavirus on Global Defined Contributions Plans,” July 2020.

Organization for Economic Co-operation and Development (OECD), “Retirement Savings in the time of COVID-19,” June 22, 2020.

Organization for Economic Co-operation and Development (OECD), “Retirement Savings in the time of COVID-19,” OECD Monograph, forthcoming Fall 2020.