State-Facilitated Retirement Savings Programs and Defined Contribution Plans: A Comparative Review of Investment Design and Cost Structures

By Julian M. Regan and Vanessa Vargas Guijarro

Most of today’s state-facilitated auto-IRA retirement savings programs require employers who do not offer their workers a qualified retirement plan to automatically enroll their workers into an individual retirement account (auto-IRA). Like employer-sponsored defined contribution (DC) plans, auto-IRA programs — first enacted beginning in 2015 — are guided by fiduciary objectives of helping employees build retirement security by encouraging participation and contributions, while facilitating asset diversification and the accumulation of savings. State-facilitated auto-IRA programs have the potential to play a significant role in addressing the gaps and inequities in retirement plan coverage and the accumulation of retirement savings in the U.S.

The design of a retirement savings program’s investment menu, its cost structure and fee transparency are important enablers of a participant’s ability to build high-quality, well-diversified portfolios that will generate risk-adjusted returns over time. While their statutory frameworks, eligibility requirements, and features differ, state auto-IRA programs and DC plans reflect the industry’s move to innovate for the benefit of participants through adoption of auto-features, use of target retirement date funds, cost-effectiveness, and fee transparency.

U.S. Retirement System: Growth in Assets, While Gaps in Coverage Remain

U.S. employer-sponsored retirement assets, comprised of defined benefit (DB) plan and DC plan assets, held $22.5 trillion as of December 31, 2023, an increase of 97% over the $11.4 trillion of assets held in these plans at year-end 2010. Despite strong asset growth, though, large gaps in coverage and savings shortfalls remain that could have negative fiscal and social policy consequences for future generations. According to the Georgetown University Center for Retirement Initiatives (CRI), almost one-half of the private sector workforce — approximately 57 million private sector workers — do not have access to an employer-sponsored plan and workers are significantly more likely to save when they have access through their employers. More than one-half (53%) of small and mid-sized employers do not offer a plan to their workers, according to the Pew Charitable Trusts.

State-Facilitated Retirement Savings Programs

The adoption of state-facilitated auto-IRA programs by states and municipalities is one approach for closing the gap in retirement plan coverage in the U.S. and addressing disparities in coverage. According to the CRI, there are 19 state-facilitated retirement savings programs as of April 2024, and of these, 16 are auto-IRA programs. These auto-IRA programs include the following features:

- Designed with a Roth IRA as the default account while also offering a traditional IRA.

- Mandated for employers that do not offer any retirement program.

- Include auto-features, such as automatic enrollment with an opt-out feature.

- Offer a well-diversified, high-quality, low-cost, easy-to-understand investment menu, including a suite of target-date funds that enable participant diversification within a single option.

As of February 2024, the six auto-IRA states reporting monthly program data to the Georgetown CRI administered $1.34 billion in assets with more than 845,000 funded accounts and 212,000 total registered employers. While their asset and participant levels are a fraction of those of all DC plans, state-facilitated auto-IRA programs are showing steady growth to date.

The Relationship of the Retirement Savings Program and Plan Investment Menu Design

Public sector 401(a), 401(k), 403(b), and 457(b) DC and deferred compensation plans provide a supplemental benefit to traditional DB pension plans for an estimated 85% of public sector workers. In contrast, single-employer DC plans for corporate, private sector workers have become the primary retirement plan, excluding private sector participants who are members of multi-employer plans. As of December 31, 2023, DC plans in both the public and private sectors held $10.6 trillion. Today, state-facilitated programs account for a modest but growing portion of total assets in the retirement system.

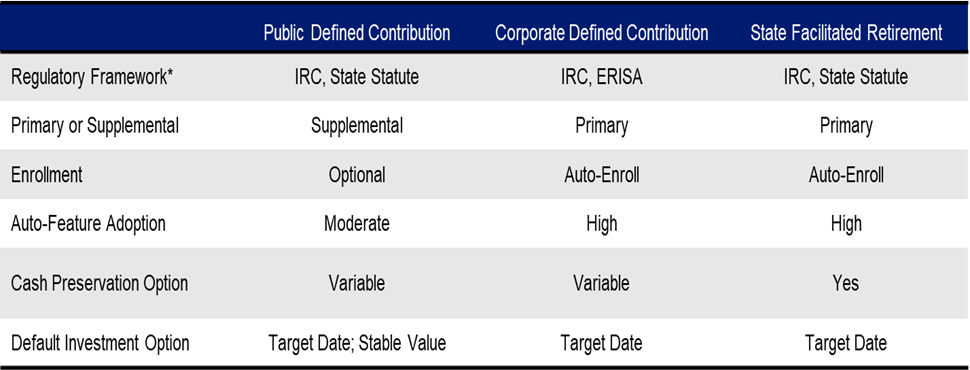

The following chart provides a comparative overview of the some of the features of each of these different types of participant-directed retirement savings arrangements.

Investment Menu Design Trends

The term “investment menu design” encompasses the asset categories, number of investment options, and investment strategies offered to a participant. These features are important determinants of a sponsor’s ability to offer a high-quality, cost-effective investment program.

Although state auto-IRA programs and DC plans differ in governance, statutory frameworks, and design, DC plans and the new state-facilitated retirement savings programs share similar objectives and best practices shaping design trends, including:

- Increasing use of target date funds as a default investment option, along with a limited number of single-asset class core options for participants who prefer to construct their own investment portfolios.

- Fewer investment options to facilitate improved participant decision-making, asset diversification, and understanding.

- Increasing use of passive management in underlying funds to keep fees low.

- Consideration of lifetime income options and other alternatives pending the industry’s development of suitable features and cost structures.

State-Facilitated Retirement Savings Programs

Among programs for which information is available, state-facilitated retirement savings programs offer a modest number of investment options encompassing age-based asset allocation funds as the default investment option and the use of passive management primarily, if not exclusively, in underlying funds to keep fees and tracking error risk low. The following is a summary based on available program information.

- All programs (100%) use a suite of age-appropriate target date funds as the default investment option for participants who have not chosen an investment option within 30–90 days.

- All programs offer a mandatory cash preservation option that holds initial contributions before a participant makes an active decision about selecting an investment option or opting out.

- The number of investment options (the suite of target date funds is counted as one option) offered under the programs ranges from three to eight.

- One program offers risk-based funds in addition to age-based asset allocation funds.

Defined Contribution Plans

The number of investment options offered by DC plans ranges widely from a relatively few offered by larger plans that may use a single custom option in each asset category to scores of options offered by 403(b) plans that use multiple vendors. Notwithstanding these variations and some conflicting data, surveys generally bear out the fact that the average number of options across plans is moving in the direction of a more disciplined number and that plans are making greater use of passive management, as evidenced by the following.

- Pensions and Investments reported that 55% of large DC plans responding to its most recent survey offered 11 to 20 investment options.

- The 2021 Brightscope/ICI DC Plan Profile report found that 401(k) plans offered an average of 21 investment options when target date funds are counted as a single option and 28 when they are not.

- NAGDCA reported the median surveyed public plan in 2018 offered 24 options, excluding a brokerage window.

- The 2023 Brightscope/ICI report found that 41% of 401(k) plan assets were allocated to index funds, while NAGDCA reported that the percent of public plan assets allocated to index funds increased to 34% in 2018 from 22% in 2015.

Cost Structures

Total plan costs, as measured by asset-weighted administrative, record-keeping, and investment management expenses have declined materially among public and private sector programs in the past two decades. Buying power as measured by total plan assets is a major determinant of a program’s ability to reduce asset-weighted administrative and investment management expenses. Because state-facilitated retirement savings programs are new, an “apples-to-apples” comparison to DC plan cost structures is meaningful only after adjusting for the estimated impact of market values.

Notwithstanding significant size differences, state-facilitated auto-IRA programs and DC plan data evidence the move toward cost-effectiveness and fee transparency. Moreover, these programs offer significant quality, cost, and oversight advantages in comparison to higher-cost retail investment programs.

State-Facilitated Retirement Savings Program Fees and Expenses

- Program asset-based fees, which do not include investment management or flat fees, ranged from 0.26% of assets annually to 0.75%, annually, based on data available from five programs’ websites as December 31, 2023.[i]

- Target date funds, most of which use passive management, were all age-based and charged annual asset-based fees of 0.09%–0.75%.[ii]

- The fees for the non-target date options ranged from 0.02% to 0.34%.[iii]

- While security selection in underlying funds is implemented through the low-cost passive management, target date funds’ glidepaths are actively implemented.

Defined Contribution Plan Fees and Expenses

Total plan costs, as measured by asset-weighted administrative, record-keeping, and investment management expenses, have declined among plans, as has been reported extensively in industry studies and publications. For example:

- Brightscope/ICI reported that the average 401(k) plan participant plan incurred a total plan cost of 0.51% of assets in 2020, down from 0.65% in 2009, inclusive of administrative, investment management, and other fees.

- Morningstar reported that the asset-weighted expense of 401(k) plans in 2017 was 0.58% of plan assets, down from 0.65% in 2009.

- NAGDCA reported that its surveyed plans’ asset weighted expenses were 0.45% in 2018, a decline from 0.51% reported in 2015.

Conclusion

Due to their varying roles, stakeholder differences and regulatory frameworks, state-facilitated auto-IRA retirement savings programs and DC plans will continue to include differences in the design of their investment menus. However, both are positioned to play important roles in helping to achieve the public policy objectives of enabling retirement security for working Americans and addressing disparities in retirement program coverage among ethnic groups and genders.

As state-facilitated auto-IRA retirement savings programs continue to grow in number and importance, and as DC plans continue their growth, it is important that participant-directed savings programs continue to adopt best practices while exploring future innovations. Evidence of adoption of best practices is provided by the fact that participant-directed retirement savings programs, including state auto-IRA and defined contribution plans, are continuing the move toward offering a disciplined number of investment options, while including high-quality target date funds that facilitate diversification across multiple asset classes within a single vehicle as the default option, active glide path management to maximize asset allocation effectiveness, and passive management in underlying funds to enable cost-effectiveness.

Because they are not encumbered by the build-up in investment options that affected many DC plans in previous decades, auto-IRA programs are able to start with a “clean sheet of paper” and offer fewer options.

Looking to the future, DC plans and auto-IRA programs also will increasingly have to consider including lifetime income options. As the American workforce ages, how retired participants receive their accumulated savings — already a critical consideration — will grow in importance. While obstacles remain in this area, the progress state-facilitated auto-IRA programs and DC plans have made in designing effective investment programs holds great promise for future innovations that will benefit participants at all stages of their careers.

Julian M. Regan is Senior Vice President and Public Sector Market Leader, and Vanessa Vargas Guijarro is a Vice President and Senior Consultant, with Segal Marco Advisors.

Segal Marco Advisors is a supporter of the Center for Retirement Initiatives. The views and opinions expressed in this blog post are the views of the author and do not reflect any policy or position of the Center for Retirement Initiatives.

April 2024, 24-02

[i] Based on fee data published on five state program websites. Fees are subject to change. The categorization and structure of fees varies differs among programs.

[ii] Asset-based investment management fees are subject to change over time.

[iii] Investment option fees may not be identical to gross and net expense ratios for underlying mutual funds and may change over time as programs consider adding or eliminating non-target date options in the future.

Additional Resources

BrightScope and Investment Company Institute. The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at 401(k) Plans, 2020, September 2023.

BrightScope and Investment Company Institute. The BrightScope/ICI Defined Contribution Plan Profile: A Close Look at 401(k) Plans, 2018, 2021.

Investment Company Institute. Retirement Assets Total $38.4 Trillion in Fourth Quarter 2023, March 2024.

National Association of Government Defined Contribution Administrators, Inc. 2019 Perspectives in Practice Survey Report (Based on 2018 Results), 2019.

National Association of Government Defined Contribution Administrators, Inc. 2018 Perspectives in Practice Survey Report (Based on 2018 Results), 2018.