CRI’s State-by-State Analysis of the

Who Lacks Access to Retirement Savings and the Potential Benefits of State-Facilitated Retirement Savings Programs

Research by the Georgetown University Center for Retirement Initiatives in conjunction with Econsult Solutions, Inc., with support in part from the American Retirement Association, provides state-level analysis of the who lacks access to retirement savings options in the states and the benefits of expanding private sector worker access to save for retirement with a state-facilitated program.

View National-Level Fact Sheet

How Have State Programs Contributed to Closing the Access Gap? CRI’s Early Adopter Analyses for CalSavers, Illinois Secure Choice, and OregonSaves highlights how each state program has directly and indirectly contributed to expanding access through the state program and new private sector induced retirement plan adoption.

View the Early Adopter Fact Sheets

CalSavers

Illinois Secure Choice Retirement Savings Programs

OregonSaves

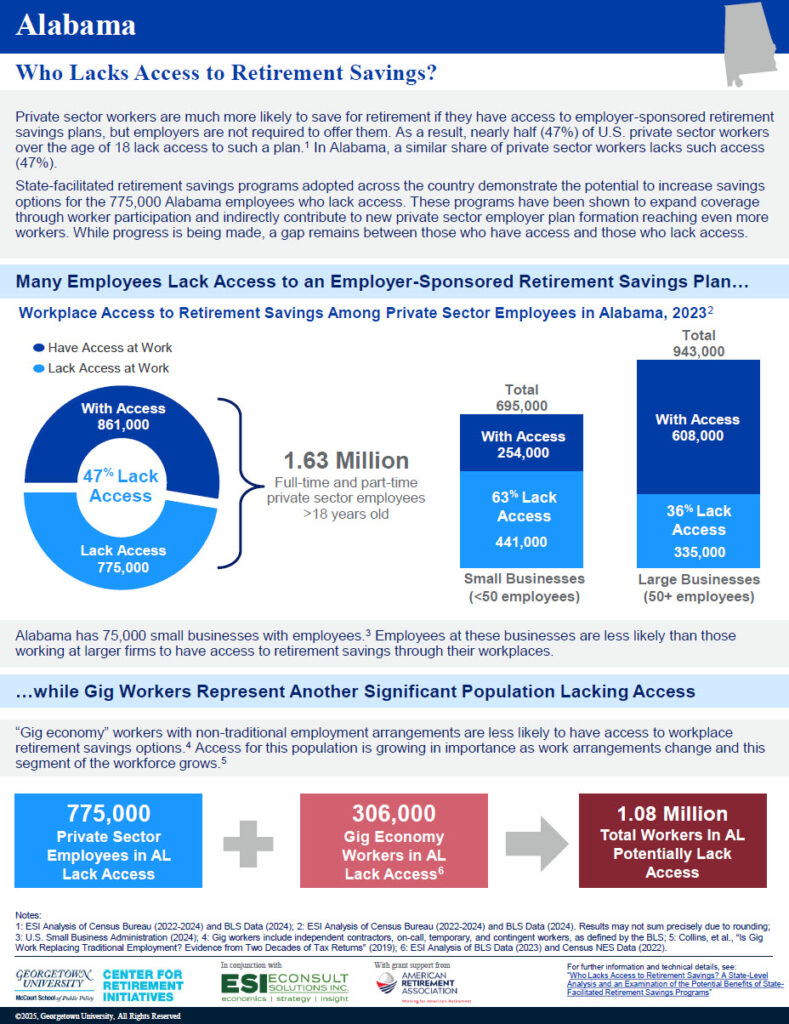

Click on a state in the map below to view its two-page fact sheet providing information on key state specific metrics on the retirement savings access gap for private sector workers, the aging of the population, the economic and fiscal benefits to the state of adding new savers, and the projected growth in savings and retirement income with an auto-IRA program, including the potential additional benefit of the new Saver’s Match.

Source: Georgetown University’s Center for Retirement Initiatives

| ≥ 50% | |

| 41%-49% | |

| 30-40% | |