Staying the Course Through Turbulent Markets

May Lead to Better Retirement Outcomes

By Jonathan Barry and Jessica Sclafani

Volatile markets can be unsettling. As we manage through these unprecedented times, many defined contribution (DC) plan participants are understandably concerned about their investments, and may be wondering whether they should be making significant changes to their retirement accounts. Some participants may be tempted to move their investments to cash. Others may stop contributions to their retirement plans altogether, either due to the loss of a job and the lack of access to an employer-sponsored plan, or because of concerns about meeting day-to-day expenses. Still others may be considering a loan from their DC accounts, and recent legislation1 has made such loans even more flexible than before.

While these may be tempting options, and in some cases, the only options available to meet living expenses, taking these actions can have significant long-term implications on retirement savings. History has shown that participants who stayed invested and kept savings fared better over time than participants who made significant changes to their DC accounts during market downturns.

Learning from the Past

Although past performance is no guarantee of future results, the global financial crisis of 2008 and 2009 (GFC) and subsequent market recovery as of December 31, 2019, provide an interesting backdrop with which to assess the potential impact of making significant changes to retirement accounts. We modeled potential outcomes for three hypothetical participants, assuming that at December 21, 2008, they made (or didn’t make) a significant change to their retirement accounts.

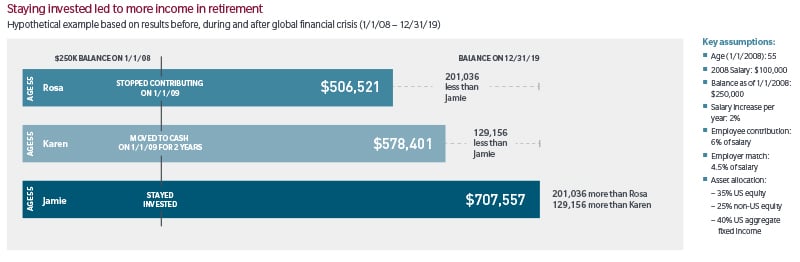

Our first hypothetical participant decided to stop contributing entirely on January 1, 2009; the second participant decided to move her retirement assets to cash for a period of two years (2009–10); and the third participant took no action, deciding to stay the course, stay invested, and aim to weather the storm. Exhibit 1 shows how the account balances fared for each participant through December 31, 2019.2

Exhibit 1

Source: MFS® Case Study, “Keeping Calm and Invested During Declines Led to Better Outcomes.”

Source: MFS® Case Study, “Keeping Calm and Invested During Declines Led to Better Outcomes.”

By staying invested, contributing regularly, and maintaining an asset allocation based on his needs, Jamie benefited from the market’s rebound after the GFC, and the compounding of new contributions and gains resulted in a balance of more than $200,000 greater than Rosa, and nearly $130,000 greater than Karen; significant amounts that could make a difference in whether or not they can meet their retirement income needs. Karen’s decision to move to cash may have reduced her stress for a period of time, but it can be very difficult for participants to determine when to get back into the market. While she did benefit from the ensuing bull market, she missed out on a substantial portion of the market rebound. Rosa’s decision to stop saving cost her more than $200,000 compared to Jamie, which could be a high price to pay for ceasing an activity that was already a part of her day-to-day financial life.

Thinking Long-term about Loans

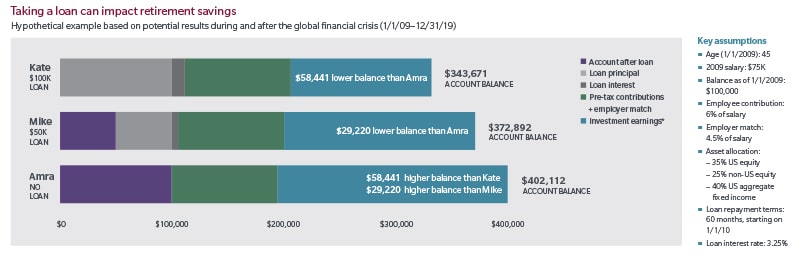

To consider the potential impact that loans can have on a retirement account, we modelled outcomes for two hypothetical participants who accessed loans from their 401(k) accounts during the GFC versus a third participant who did not take a loan. We assumed each participant had $100,000 in his or her account at January 1, 2009. The first participant took a $100,000 loan, while the second participant took a $50,000 loan3. Exhibit 2 shows how the account balances fared over an 11-year period for each participant through December 31, 20192.

Exhibit 2

Source: MFS® case study, “Caution: Taking a Loan From Your 401(k) Can Impact Retirement Balances.”

We see from the Exhibit 2 that Kate’s $100,000 loan resulted in an account balance that was about $58,000 less than Amra’s, while Mike’s $50,000 loan resulted in a shortfall of more than $29,000 as compared to Amra. In addition to missing the potential growth in the account due to market movements, taking out such loans creates tax implications that go beyond the ultimate account balance. When a participant takes out a loan from a DC plan, they make loan repayments with after-tax dollars, which undoes the benefit that participants get from making pre-tax contributions to the plan. For example, if Kate had a marginal tax rate of 22%, she would have had to pay nearly $25,000 in taxes on her loan repayments, with a resulting lower take-home income during the loan repayment period.4

Conclusion

We acknowledge that in these challenging times, retirement savings may have to be a lower priority for many. However, we hope these examples help illustrate the potential longer-term implications of actions taken today.

Jonathan Barry, FSA, CFA, EA, MAAA, is a Managing Director and Head of Client Solutions in the Investment Solutions Group at MFS Investment Management® (MFS®). He is responsible for working with clients to help address their needs and objectives, including governance, investment policy, and asset allocation.

Jessica Sclafani, CAIA, is a Director and Defined Contribution Strategist for the Investment Solutions Group at MFS Investment Management® (MFS®). Her responsibilities include leading defined contribution research and the firm’s thought leadership agenda, as well as working extensively with the firm’s client-facing teams to represent MFS in the marketplace.

MFS Investment Management (MFS®) is a supporter of the Center for Retirement Initiatives.

The views and opinions expressed in this blog post are the views of the authors and do not reflect any policy or position of the Center for Retirement Initiatives. Neither MFS Investment Management nor its subsidiaries is affiliated with Georgetown Center of Retirement Initiatives.

1 On March 27, 2020, Congress passed the CARES Act in response to the economic downturn caused by COVID-19. The Act includes several retirement plan provisions, including an exemption from the 10% early withdrawal penalty for coronavirus-related distributions, a waiver of required minimum distributions in 2020, and enhancements to loan-related provisions from employer retirement plans. In particular, participants can now take up to $100,000 in loans, or 100% of the vested account balance if that is less from the plan, and defer repayment of the loan for one year. Note that plan sponsors are not required to implement the loan-related provisions of the CARES Act.

2 Source: SPAR, FactSet Research Systems Inc., MFS analysis. For purposes of these comparisons, return calculations were based on monthly returns from January 1, 2009, through December 31, 2019, for the following indices: the S&P 500 Stock Index, which measures the broad U.S. stock market; Bloomberg Barclays U.S. Aggregate Bond Index, which measures the U.S. bond market; MSCI EAFE Index (net), which measures the non-U.S. stock market. Index performance does not reflect the deduction of any investment-related fees and expenses. It is not possible to invest directly in an index. Asset allocations are rebalanced monthly. Pay increases are effective on January 1 of the following year. Contributions and match are made at month-end. The use of a systematic investing program does not guarantee a profit or protect against a loss in declining markets. You should consider your financial ability to continue to invest through periods of low prices. Past performance is no guarantee of future results.

3 The maximum loan amount available under IRS rules in effect at January 1, 2009, would have been $50,000. The example is for illustrative purposes only, to show the hypothetical impact of how a $100,000 loan as allowed under the CARES Act could have affected the account balance.

4 Participants typically repay their 401(k) loans with post-tax dollars. In this example, Kate’s hypothetical loan repayments total $112,059; if Kate had a marginal tax rate of 22%, she would pay roughly $24,700 in tax on these repayments over the life of the loan.

Note: Hypothetical examples are for illustrative purposes only and are not intended to represent the future performance of any MFS® product.

The views expressed are those of the authors and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice from the advisor. No forecasts can be guaranteed. Keep in mind that no investment strategy, including allocation, diversification and rebalancing (ADR), can guarantee a profit or protect against a loss. Also, all investments carry a certain amount of risk, including the possible loss of the principal amount invested.

The investments or strategies you choose should correspond to your financial situation, needs, goals, and risk tolerance. For assistance in determining your financial situation, please consult an investment professional.

August 2020, 20-09

Additional Resources

MFS Investment Management, “Keeping Calm and Invested During Declines Led to Better Outcomes,” April 2020.

MFS Investment Management, “Caution: Taking a Loan from Your 401(k) Can Impact Retirement Balances,” June 2020.