By Patrick McNamara, Angela M. Antonelli and Laura Kim

After decreasing with the onset of the Great Recession, debt levels are once again rising. At the end of 2018, overall household debt reached an all-time high. A closer examination highlights two significant and troubling trends: student loans represent an increasingly large portion of aggregate debt, and older Americans bear a growing proportion of this burden.

Student loan debt, which can have a negative impact on the ability of younger workers to save for retirement, is now the second-largest component of household debt. What is not well understood is the impact of rising student debt on older Americans who, having presumably taken on such debt either for themselves or for their children, now find it very difficult to pay off these balances. While it is more common to worry that young people may not be able to adequately save for a retirement still two or three decades away because of their student loan debts, more older Americans are potentially putting their retirement at risk with no time left to catch up.

Household Debt Rises to Pre-Great Recession Levels

Borrowing is back. Although consumer debt declined from its 2008 peak with the onset of the Great Recession, it has been rising steadily since 2014. Credit card, auto loan, and student loan debts have now all reached record levels.

As a result, by the end of 2018 American aggregate household debt stood at $13.54 trillion, 6.8% higher than a decade earlier and more than $2 trillion higher than in 2013. Mortgage debt remains the largest contributor to this at $9.12 trillion, worryingly close to its pre-recession, all-time peak reached in the third quarter of 2008.

Older Americans are contributing more to this increase. The debt held by Americans over 60 is now $3.09 trillion, up from $1.98 trillion a decade ago, with mortgage debt making-up the vast majority (70%) of the burden. By comparison, the debt level of those aged between 50 and 59 over the same period is relatively unchanged ($3.16 trillion versus $3.03 trillion), and for those aged 40 to 49 it has fallen.

The Rapid Growth of Student Loan Debt and Rising Defaults

At the heart of this rapid growth is student loan debt. Student debt is now the second-largest component of household debt. The average student debt stood at $32,371 in 2016. Borrowers in their 30s hold the highest level of student debt and Americans now collectively owe $1.46 trillion, up from $241 billion in 2003. This represents a staggering 505% increase in just 15 years.

The ability of millennials to start saving for retirement is put at risk as they prioritize paying off their loans and other monthly living expenses, such as rent. Defaults are rising. According to Pew, as of October 2018, “one in five federal student loan borrowers – more than 8 million Americans – are in default, and millions more are struggling to make payments.”

Older Americans Are Overlooked in the Student Loan Debt Crisis

While the rising student loan debt burden, and its effects for millennials and overall indebtedness, should be of great concern, one less-discussed but still significant impact has been on older Americans in-or-near retirement.

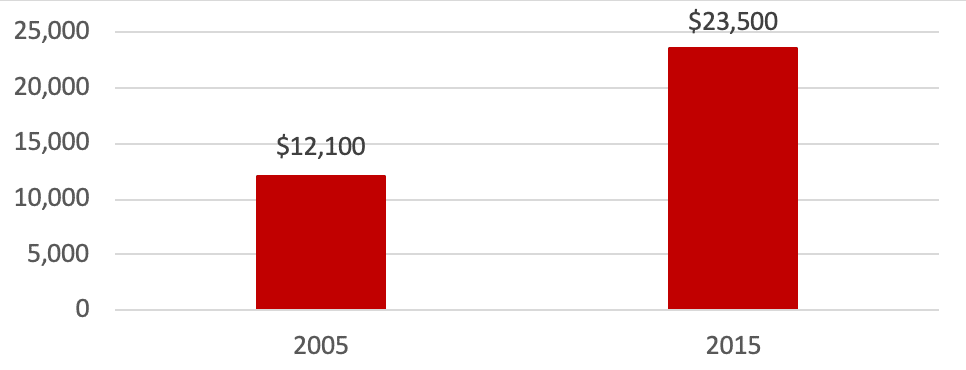

According to the Consumer Financial Protection Bureau (CFPB), the number of Americans aged 60 and older “with student loan debt quadrupled between 2005 and 2015,” from 700,000 to 2.8 million. The CFPB estimated this group owed $66.7 billion in student loans in 2015 and was reportedly the “fastest growing age-segment of the student loan market.” In addition, the number of borrowers in this age group increased by at least 20% in every state, and by at least 46% in half of the states between 2012 and 2017. For those aged 60 and older, the average amount of student loan debt almost doubled, increasing from $12,100 to $23,500.

| Average Amount of Student Loan Debt Owed by those 60 and Older Have Nearly Doubled between 2005 and 2015 |

|

| Source: Consumer Financial Protection Bureau, Office for Older Americans & Office for Students and Young Consumers, “Snapshot of older consumers and student loan debt,” January 2017 |

There have been two primary causes of this:

- The increase in parents or guardians co-signing on their children’s private undergraduate student loans, up from 74% in the 2008-2009 academic year to 93% in 2018-2019.

- The increase in the number of adults over the age of 25 going back into education, which peaked in 2010, to aid their job prospects in a challenging market.

These factors taken together have increased the student debt burden on older Americans substantially. To be able to go back to school, many chose to take out loans that likely did not prove a good return on investment. Meanwhile, the Brookings Institution reports that “the average annual borrowing amount for parents has more than tripled over the last 25 years, from $5,200 per year in 1990 (adjusted for inflation) to $16,100 in 2014.”

What is also likely to be little known or understood is defaults on student loans have resulted in an increasing number of older Americans having their Social Security benefits garnished. When you fall behind on payments for federal student loans, the government can make up what you owe by taking deductions from your Social Security benefits. In fiscal year 2015, approximately 114,000 borrowers aged 50 and older had their benefits offset to repay defaulted federal student loans, totaling approximately $171 million.

|

$171 million

Amount collected in fiscal year 2015 through Social Security benefit offsets from approximately 114,000 older borrowers age 50 and older to repay their defaulted federal student loans.

|

| Source: U.S. Government Accountability Office, “Social Security Offsets: Improvements to Program Design Could Better Assist Older Student Loan Borrowers with Obtaining Permitted Relief (GAO 17-45),” December 2016 |

The Crisis is Real, But Solutions Are Available

For younger workers, this tale of crushing student loan debt will sound familiar. Most millennials have nothing saved for retirement, and those who are saving are not saving enough. According to the National Institute on Retirement Security, 66% of working millennials have nothing saved for retirement and only 5% are saving adequately.

The LIMRA Secure Retirement Institute found that, when compared with their peers without debt, millennials entering the workforce with $30,000 in student loan debt risk ending up with $325,000 less in retirement. Given that the average student debt in 2015 was $33,000, this suggests that many graduates will face significant difficulties building their retirement nest eggs.

Student debt is reducing the ability of millennials to save for the day decades from now when they stop working. Unfortunately, we already see the retirement of today’s workers being threatened because of rising debt burdens they are carrying into old age.

Policymakers have taken note of the growing student loan crisis and a recent report by the Aspen Institute highlights the range of solutions being proposed, including canceling some or all of the outstanding debt or expanded use of income-driven repayment plans. While much attention has been focused on the impact of student debt on millennials, any policy reforms must take into account the full scale of the problem, including the role it plays in the lives of older Americans.

Conclusion

American consumers have a long history of acquiring debt and failing to save. Whether buying a first home or a new car, borrowing today for tomorrow is not new. What is new, however, is the volume of debt, the share held by older Americans, and the increasingly dominant role of student loan debt.

Student debt has long-affected younger Americans’ abilities to save for retirement, and the prospects for enjoying a retirement as prosperous as their grandparents seem dim for most millennials. Lost in this, however, is the reality that older Americans today are already feeling the effects of the rising cost of college, with the prospect of student loan and other debt already putting their financial security at risk. Together, the bookends of the American population are increasingly feeling the squeeze as their investments in education, instead of brightening the future, form a dark cloud looming over their retirement.

Patrick McNamara and Laura Kim are Research Assistants, and Angela M. Antonelli is Executive Director of the Georgetown University Center for Retirement Initiatives.

April 2019, 19-04

Additional Resources

Aspen Institute, “Student Loan Cancellation: Assessing Strategies to Boost Financial Security and Economic Growth,” April 2019.

Brookings Institution, “Parents are borrowing more and more to send their kids to college—and many are struggling to repay,” November 2018.

Consumer Financial Protection Bureau, “Older consumers and student loan debt by state,” August 2017.

Consumer Financial Protection Bureau, Office for Older Americans & Office for Students and Young Consumers, “Snapshot of older consumers and student loan debt,” January 2017.

Federal Reserve Bank of New York, Center for Microeconomic Data, , “Quarterly Report on Household Debt and Credit (2018: Q4),” and “Data Underlying Report,” February 2019.