By Paula Campbell Roberts

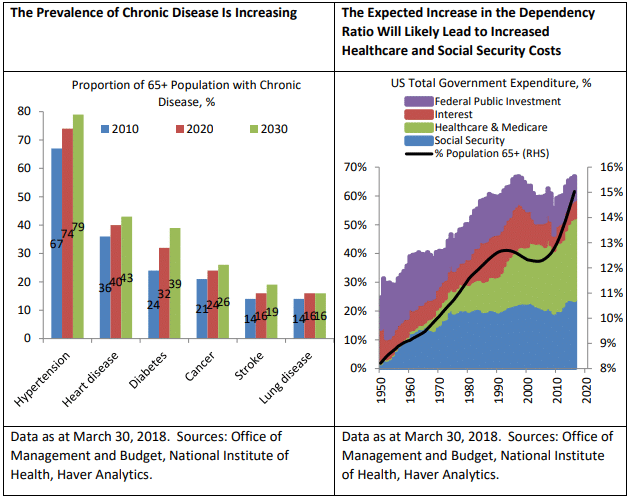

When the post-World War II babies entered the workforce in the 1970s, about 10 percent of the US population was over age 65. By 2030, that number is expected to grow to 20 percent of the population. The net impact of the aging of our population will be slower economic growth if all else remains equal. As more Americans retire, this will make economic expansion more difficult.

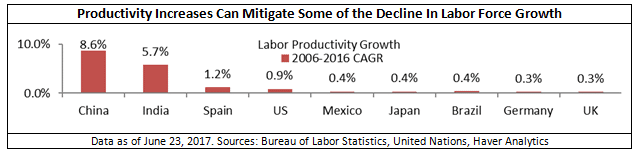

The key here is “if all else remains equal.” The good news is that businesses can invest more and increase productivity to reinvigorate economic growth. Economic growth, as measured by the Gross Domestic Product (GDP), can be thought of in simplified terms as the growth in the working age population multiplied by productivity. That gives companies an important lever to use to mitigate the impact of the aging of America.

Underlying the overall economic outlook of these demographic changes are a handful of key themes that we should recognize.

- Greater Diversity. The population is not just getting older, it is becoming more diverse. Over the next 15 years, the population will see a net increase of about 35 million as births continue to exceed deaths. More than half of that growth will be the result of an increase in the Hispanic population.

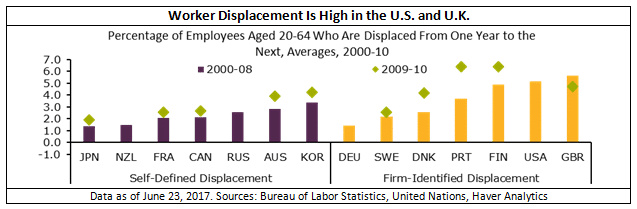

- Structural Worker Displacement. Perhaps the best way to improve productivity is technological innovation. The downside is that this displaces existing workers as more tasks become automated and businesses become more efficient. In fact, the United States trails only the United Kingdom in worker displacement rates. In this country, we spend relatively less than the rest of the world on comprehensive workforce retraining and similar programs to mitigate the impact on displaced workers. Without careful planning and support, this can lead to working-age Americans leaving the workforce, which has a negative impact on both the individual and the economy.

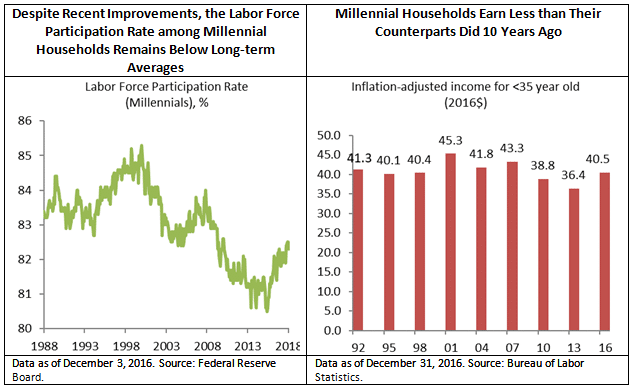

- Millennial Struggles. The millennial population is underemployed, over-indebted, and not saving much. Retirement and healthcare systems must be adapted to better serve the gig economy that employs many millennials. More work has to be done to ensure that these workers have relevant skills to prepare them for available jobs. The stark reality is that households under 35 years old earn less today on average in inflation-adjusted dollars than they did a decade ago ($40,500/year vs. $43,300).

- Healthcare, Social Security, and Government Spending. As Americans live longer, pressure will continue to rise on government retirement and safety net programs. A majority of older Americans live with a chronic disease, and those figures will only grow over time.

- Changes in Consumer Spending. Much of the broader changes in consumer spending can be explained by population shifts and the spending habits of those segments. Hispanics spend more than others on food at home, while millennials allocate more to dining out. Both groups spend disproportionately on rent, while elders spend vastly more on healthcare. Understanding these shifts and their impacts on spending habits have huge implications for investors and policymakers.

- Homeownership vs. Renting. Every segment of the population is seeing movement away from homeownership. The trend toward renting is likely to continue. Although some believe that economic factors have driven higher rentership, the reality is that a careful look at the data reveals that other dynamics are at play. Even high-income segments have seen a growth in rentership, possibly because of high job mobility and more real estate development catering to (and marketed at) this portion of the population. At the same time, seniors and empty nesters may be looking for city living or increased access to services that often come with renting.

- The New Sharing Economy. As the sharing economy blossoms, it heralds a real change for important economic sectors like automobiles. Millennials and those over 65 are less likely to have driver’s licenses. In states with high ridesharing growth, there tends to be a correspondingly lower percentage of licensed drivers. For instance, California has a lower proportion of licensed drivers than the U.S. overall (81.2% vs. 83.9% nationally) and has nearly three times the growth rate for ridesharing (145% vs. 48% nationally).

- Urbanization. It is expected that 66 percent of the population will live in urban areas by 2050, up from just 47 percent in 2000. Seniors are helping to drive this expansion as they opt to leave suburban and rural homes in favor of city living. This substantial shift to cities will put increasing pressure on infrastructure and require substantial investments to keep pace and provide needed services.

Conclusion

An older, more-diverse American population is driving meaningful changes to the economy. Examining the underlying data helps reveal important trends that lead to better policy and investing decisions.

Despite the challenges presented by the aging of America, the United States is well positioned for the future because of the millennial cohort. In developed markets, the U.S. has the largest percentage of millennials, and these individuals present great potential.

The key will be to help millennials achieve that potential. They’re not as well situated financially as they could be at this point in their lives. The gig economy is here to stay and we need to ensure that government and private sector solutions for retirement, healthcare, and other key support services keep pace with the innovations that enable more-flexible work structures.

Understanding and appreciating these demographic and economic shifts will enable policymakers and investors to make wise choices that embrace change and facilitate innovation and growth.

Paula Campbell Roberts is the Director, Global Macro & Asset Allocation Team, Kohlberg Kravis Roberts & Co. (KKR). This blog post is a summary of remarks delivered by Ms. Roberts at the CRI’s June 2018 Policy Innovation Forum. Her full presentation and supporting materials can be found on the CRI website.

KKR is a supporter of the Center for Retirement Initiatives. The views and opinions expressed in this blog post are the views of the author and do not reflect any policy or position of the Center for Retirement Initiatives.

September 2018, 18-07

Additional Resources

Paula Campbell Roberts, Ken Mehlman. What Does an Aging Population Mean for Growth and Investments? Viewpoints, Volume 1.1, February 2018.

Nicholas Eberstadt. Population, Poverty, Policy: Essential Essays from Nicholas Eberstadt. AEI Press, January 2018.

John Burns. Big Shifts Ahead: Demographic Clarity for Business. Advantage Media Group, 2016.