What’s Old is New Again: The Potential Benefits of Reopening Your Defined Benefit Plan

By Jonathan Barry

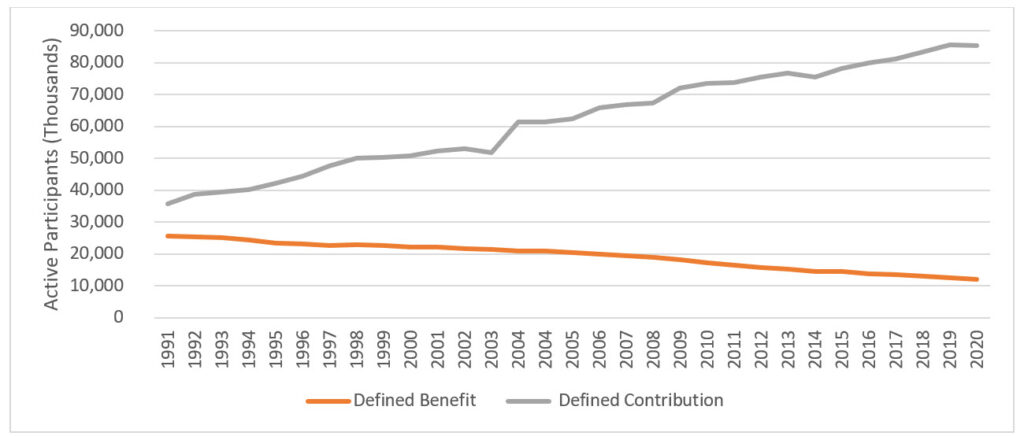

Once a key employee benefit, corporate defined benefit (DB) plans have been on the decline over the past several decades. The U.S. has seen a dramatic transition from DB to defined contribution (DC) plans (see Exhibit 1).

Exhibit 1: Number of Active Participants in Private Pension Plans

Over this time, active DB participation has declined from 26 million to 12 million, while active DC membership has grown from 36 million to 85 million. Today, only 15% of private sector workers have access to a DB plan and only 23% of workers who participate in a DB plan are in one that provides accruals to all members, meaning there are millions of workers with frozen DB benefits.

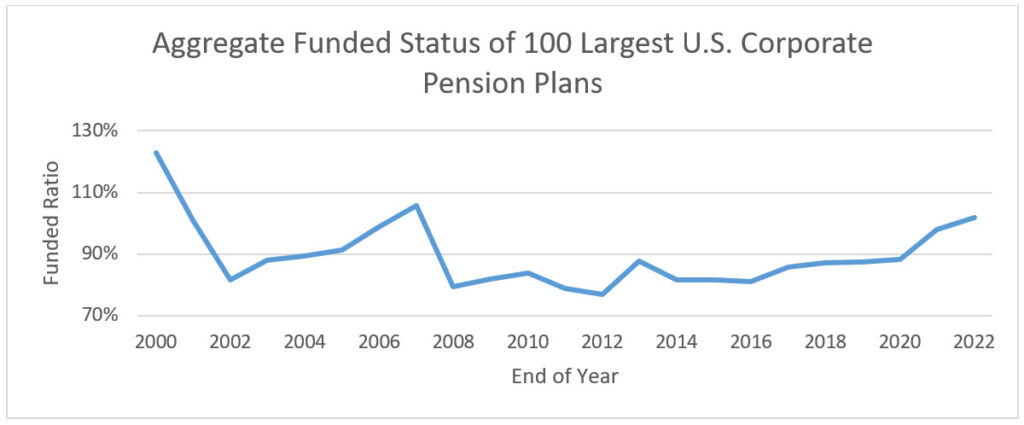

However, rising interest rates in 2022 reduced liabilities, improving funded status, and resulting in many plans now being at or above 100% funded status for the first time in years (see Exhibit 2).

Exhibit 2: Aggregate Funded Status of 100 Largest U.S. Corporate Pension Plans

DB Plans: The Ultimate Retirement Income Product?

Our 2023 MFS Global Retirement Survey found that retirement confidence is on the decline, with 58% of respondents indicating they would need to work longer than planned and 32% indicating they would not be able to retire at all. Furthermore, 75% of respondents ranked “receiving a predictable stream of income payments throughout retirement” as one of the top elements they want to see in a retirement portfolio.

Much effort has focused on developing products that incorporate guaranteed income features in DC plans. However, uptake of these solutions has been low, since they can be difficult for participants to understand and can present administration and governance challenges. For sponsors concerned about retirement income, the answer may lie in their existing DB plans — the DB plan is a time-tested vehicle designed to provide lifetime income, while also pooling longevity and investment risk for participants.

Some DB Design and Investment Considerations

Plan sponsors have many options today regarding the type of DB plan offered to employees. Traditional DB plans tended to have final average pay formulas, where benefit accruals increased in value as participants neared retirement. Other designs have evolved, such as cash balance and variable benefit plans, that offer employers alternatives and deliver DB benefits that can avoid the steep cost increases that come with traditional final average pay formulas.

To highlight a recent example, IBM announced in late 2023 that it will replace its 401(k) match with a new cash balance accrual from its existing DB plan, which had been frozen since 2008. This is a sign that some companies are reevaluating how they provide retirement benefits in ways we have not seen in years.

From an investment perspective, Liability-Driven Investing (LDI) has been well-established for many years. LDI has demonstrated its effectiveness, with glide path strategies reducing risk as funded status improves, and carefully constructed fixed-income portfolios moving in line with plan liabilities as interest rates rise and fall.

In a reopened DB plan, LDI will continue to be critical, but sponsors should consider whether adjustments are warranted. With yields at the highest levels in years, sponsors may want to consider whether broader fixed-income exposure, such as intermediate credit, global bonds, or taxable municipals, could help to improve returns while retaining liability hedging characteristics. Sponsors should also optimize equity allocations to help achieve desired outcomes. For example, defensive equity strategies seek to provide lower absolute volatility, while still offering opportunity for growth.

DB Plans Also Could Help Solve the Labor Market Challenge

The U.S. faces a labor shortage that could have long-term effects on economic growth and productivity. Job losses, retirements, and “quiet quitting” seen during the global pandemic were an acceleration of a trend that had been in place for decades. The lower participation rate is a function of several factors, including an aging U.S. workforce, workers staying at home to care for family, and health-related issues (see Exhibit 3).

Exhibit 3: Labor Force Participation Rate

In a difficult labor market, DB plans could play a key role in employee retention. For industries where it is difficult to find workers, a restarted DB plan could help retain experienced employees while reducing retirement-related worries that can have an impact on productivity. This could also enable a more orderly and predictable workforce transition, by providing opportunities for younger workers as experienced workers leave the workforce in a predictable pattern.

Conclusion: Can Plan Sponsors Afford Not to Consider This?

If a DB plan can help retain a portion of the workforce who may be at risk of leaving, DB accruals could also be funded through savings generated from lower hiring costs and avoiding productivity loss that arises from unplanned turnover. The cost to hire a new and executive hire is estimated to be $4,700 and $28,300 respectively, and many employers estimate the true cost of hiring to be three to four times the position’s salary.

Sponsors that benefited from improved funded status in 2022 may be able to use surplus assets in part or in whole to fund new benefit accruals, as well as cover certain administrative expenses. Sponsors should consider the savings that could arise from higher employee retention that might arise with a restarted DB plan.

Jonathan Barry, FSA CFA is a Managing Director in the Investment Solutions Group at MFS Investment Management.

MFS Investment Management is a supporter of the Center for Retirement Initiatives. The views and opinions expressed in this blog post are the views of the author and do not reflect any policy or position of the Center for Retirement Initiatives.

Disclosures:

MFS 2023 Global Retirement Survey, US Results. Methodology: Dynata, an independent third-party research provider, conducted a study among 1,000 Defined Contribution (DC) plan participants in the US on behalf of MFS. MFS was not identified as the sponsor of the study. To qualify, DC plan participants had to be ages 18+, employed at least part-time, actively contributing to a 401(k), 403(b), 457, or 401(a). Data weighted to mirror the age gender distribution of the workforce. The survey was fielded between March 22 and April 6, 2023. We define generational cohorts as follows: Millennial ages 26–41; Generation X ages 42–57; Baby Boomer ages 58–77.

The views expressed herein are those of the MFS Investment Solutions Group within the MFS distribution unit and may differ from those of MFS portfolio managers and research analysts. These views are subject to change at any time and should not be construed as the Advisor’s investment advice, as securities recommendations, or as an indication of trading intent on behalf of MFS.

January 2024, 24-01

Additional Resources

Barry, FSA, CFA, Jonathan, What’s Old is New Again: Reopening Your Defined Benefit Plan Could Help Solve the Retirement Challenge (mfs.com), September 2023.

Savage, Jeri, The Retirement Income Dilemma (mfs.com), October 26, 2023.

Zuss, Noah, Analysts Agree IBM Pension Thaw Benefits Both Participants and Plan Sponsor, PLANSPONSOR, November 20, 2023.