By Tobias Read, Oregon State Treasurer

America’s retirement savings crisis is massive, is growing, and will affect everyone. The gap between what’s saved and what’s needed is estimated to be at least $6.8 trillion nationally, according to the National Institute on Retirement Security. At the same time, more than half of the private sector workforce in the United States lacks access to an employer-sponsored retirement savings plan at work. In Oregon alone, more than 1 million private sector workers lack such access.

That’s why everyone should be happy to see the efforts of Oregon and other states to expand savings options to more people — a smart approach that will help workers of every income level and their families. Empowering more people to invest in their own futures is vital to the financial wellbeing of individuals and families alike.

In Oregon, it is working. I am pleased to report that OregonSaves is already a success, and it is still just getting started.

Tens of thousands of people in Oregon are already saving through this program. We have already eclipsed $9 million in savings by the first waves of participants, and the total assets saved are climbing by more than $1 million a month. And here’s some more great news: Most of those Oregonians had never saved before.

The public overwhelmingly supports OregonSaves. Employers say it is easy to sign up workers, and, based on a recent public survey, the level of support has increased in the first year. Today, an astounding 82 percent of people support OregonSaves.

They know it is the right approach, and that it will improve savings, making Oregon stronger, today and in the long run.

How Does OregonSaves Work?

Approved by the Legislature in 2015, OregonSaves is a public-private partnership that provides workers with the opportunity to save for retirement through payroll deductions, with the funds going into their own portable IRA accounts. Accounts are tied to the worker and not the job, ensuring that what they save will stay with participants throughout their careers and will always be their money and under their control.

If you have a business, but you don’t offer a retirement option to your workers, then you sign them up with OregonSaves. Workers can opt out if they want to, but most are staying in — about three of every four people.

The enthusiasm isn’t a surprise. We already know from research by the AARP that people are 15 times more likely to save if there is an option to do so at work.

If you are a worker, a small amount of your pay will enter your own retirement account with every paycheck. Workers participating in OregonSaves are already saving at a higher percentage of pay than expected, contributing an average of $114 per month.

Based on early demographic data, savers are more likely to be younger. This means OregonSaves is laying a foundation for a long-term culture shift, in which saving becomes the norm.

I love to hear the stories of savers, like Bud from Mt. Ashland Ski resort. Bud told us that before OregonSaves, he wasn’t sure what to do to save for his retirement. Now, with OregonSaves, to quote Bud: “… it is starting to pile up, and it makes me smile every time …” he looks at his account.

I’m also excited to see enthusiasm from businesses. Signing up workers is quick and easy.

We all know that in the long run, more saving will be better for business, because it enables employers to recruit and retain employees more competitively, while also addressing one of the highest sources of employee stress: financial problems.

Employers and Workers Strongly Support the Program

The Legislature passed OregonSaves with a simple goal: In Oregon, we want every worker to have the option to save for a better future. The program launched in a pilot phase in July 2017 and began rolling out statewide at the beginning of 2018. The program fills an important gap by expanding access to workers who have traditionally been unable to contribute to workplace retirement accounts, such as people who are self-employed or gig economy workers. Professionals such as hair stylists generally work for themselves, or for small businesses that lack employer-sponsored plans. For these workers, planning for long-term financial goals, including retirement, has often taken a back seat.

Our first-in-the-nation program is currently rolling out to employers with more than 20 employees. The statewide rollout will continue in waves through 2020, which is the deadline for firms with four or fewer workers. That said, many employers see the benefits and aren’t waiting. Employers of any size can enroll at any time before their deadlines: By February 2018, 95 employers with later enrollment deadlines chose to join the program early. This figure rose to 864 by November 2018.

The program is also open for voluntary enrollment by individuals, including the self-employed and those workers whose employers do not facilitate OregonSaves.

Since the program’s Wave One rollout began, OregonSaves has been adding approximately 1,000 employees per week. The program now has more than 44,000 employees enrolled. That number will climb rapidly in the coming years, because the majority of Oregonians without access to a plan work at small businesses.

The participation rate of eligible employees has remained steady at around 73 percent, consistent with the market research analysis completed in 2016, which estimated opt-out rates of between 20 to 30 percent. There also is potential for opt-out rates to drop over time: Data from the United Kingdom’s NEST program, a similar defined contribution workplace retirement plan that auto-enrolls employees, show the opt-out rate dropped by almost 50 percent over time.

Employee Contribution Levels Most Important to Success

The standard savings rate for OregonSaves is 5 percent of gross pay. Some thought 5 percent was ambitious and that most workers would end up saving at lower rates; however, the average savings rate has been around 5.2 percent, with workers contributing an average of $114 per month. Preliminary analysis of participant data by the Center for Retirement Research at Boston College shows that 83 percent of employees who have not opted out are sticking to the default amount, similar to worker behavior in 401(k) plans.

Assets Growing Rapidly

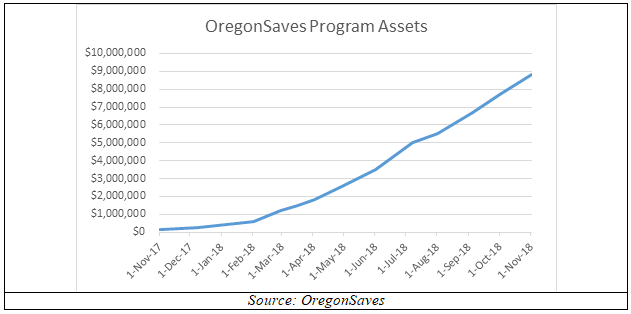

Program assets continue to grow quickly as more employers and employees enter the program. Once the program registered the first wave of employers and enrolled participating employees, assets began to accumulate rapidly. Between March 2018 and July 2018, assets increased from $1 million to more than $5 million. As of November 2018, assets have nearly doubled, now approaching $10 million.

Fees Already Lowered

The all-in fee for OregonSaves is capped at 1.05 percent of assets per year. This level is likely to drop once the program is fully implemented and assets continue to grow. According to the feasibility study, fees could drop down to 30 to 50 basis points after start-up costs are repaid.

In fact, investment fund fee reductions are already a reality. In September, State Street Global Advisors, OregonSaves’s investment manager, announced lower investment fund fees for the OregonSaves Target Retirement Funds (from 13 to 9 basis points), which is the standard investment option for participants, as well as for the OregonSaves Growth Fund (from 6 to 2 basis points). That has reduced the all-in fees for savers invested in those options accordingly.

Summing up

OregonSaves is already succeeding and achieving the goal of improved access to retirement savings. Workers and businesses across Oregon express strong support and agree about the need for the program.

The success of OregonSaves will have long-term positive implications for the savers and for Oregon. Thousands of Oregonians will save significant amounts of money for years to come as OregonSaves is phased in statewide.

Every person is different, and their retirement needs will vary, but OregonSaves and the ability to save is already improving our business climate and increasing the long-term financial stability of thousands of Oregonians.

And we are just getting started.

Tobias Read is the Oregon State Treasurer, Chair of the Oregon Retirement Savings Board, and a member of the Council of State Advisors of the Georgetown University Center for Retirement Initiatives. He is a recipient of the 2018 Excellence & Innovation Award from the Defined Contribution Institutional Investment Association (DCIIA) and Pensions & Investments.

November 2018, 18-08

Additional Resources

OregonSaves Program Website

OregonSaves News and Testimonials

DHM Research, “Support for OregonSaves remains strong,” AARP Research, September 2018.