COVID-19 & Beyond: The Need to Address Retirement Savings Access in the Workplace

By Kevin Boyles

As we begin to think about picking up the pieces from the coronavirus pandemic and its related impact on how Americans save, we again will come face to face with the pre-existing problems facing retirement savings in our country. The two main savings obstacles for workers today are access and participation. Let’s focus on the access part of the equation, because you can’t effectively begin to improve participation if there is no access.

Access to Retirement Savings — Pre-Pandemic

According to the Pew Charitable Trusts, 42% of U.S. workers had no access to a workplace retirement plan and 43% of all employers did not offer workplace retirement plans pre-pandemic.

Why are these numbers so large? One reason is that small businesses have historically struggled to find a fit when it comes to retirement savings programs, according to the 2018 Millennium Trust Small Business Retirement Survey.* The survey showed that 55% of the small businesses surveyed did not offer a retirement savings option but had previously researched one. In addition:

- 2 out of 3 that researched a retirement option explored only 401(k) plans; 100% did nothing.

- Only 28% had a solid understanding of retirement savings options other than 401(k) plans.

- Cost and a belief that their business is too small are primary reasons they did not choose to offer anything.

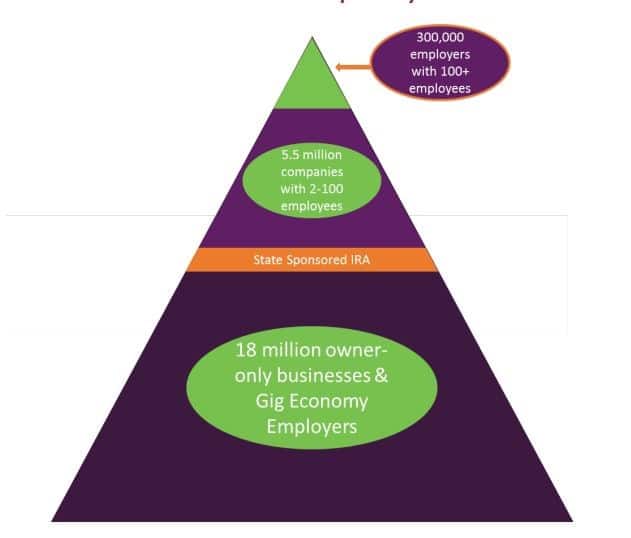

We tend to think that 401(k) plans are available everywhere, but only approximately 580,000 employers offered 401(k) plans as of 2018, leaving millions of businesses and their workers behind. In the universe of businesses in the U.S., most participation exists at the tip of the iceberg. What lies overlooked beneath the ongoing battle to improve participation are the complex layers of the workforce, where some 55 million working Americans lacked access to a workplace savings plan before the pandemic.

Between the second two layers is where state-sponsored IRA programs in states like Oregon, California, and Illinois attempt to bridge the gap for smaller employers, but these options are not available in most states to date.

This access issue has existed for more than two decades now and will require more innovative solutions from both the public sector and private sector financial services providers. The universe of potential solutions for small businesses is much larger than just 401(k) plans and state plans, where available. There also are SEP IRA plans, SIMPLE IRA plans, payroll IRA programs, and other solutions that may be a better fit for small businesses that want their employees to be able to save for retirement.

Employee Perspectives About Saving

The Millennium Trust Small Business Retirement Survey found that employees want to save through their workplaces. When asked about the likelihood to participate in a retirement program, 87% said they were likely to participate. We also found younger workers are more likely to participate in a program:

- 94% of 18–34 year olds

- 89% of 35–54 year olds

- 78% of those 55 and older

Generational Elements of Saving — Pre-Pandemic

Pre-pandemic, Millennials were already conservative and skeptical investors and savers. Why? Millennials are the first generation to live through three recessions during their formative years (ages 8–22). This group has also proven to be better savers than previous generations were at the same age — but these good saving habits may not necessarily correlate with retirement savings.

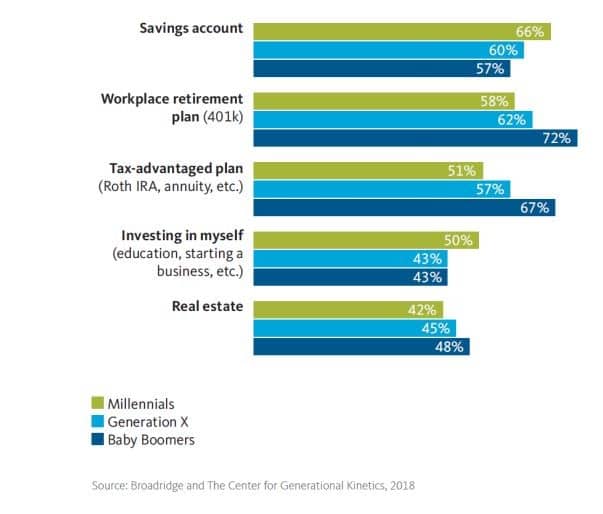

Research from Broadridge and the Center for Generational Kinetics shows that Millennials have prioritized things like their savings accounts and investing in their educations or a business more than in retirement accounts, compared to other generations.

They have also shown to prioritize emergency savings, which should become an even bigger focus for Americans in the future.

Generational Elements of Saving — Post-Pandemic

In the U.S., discretionary spending has gone down approximately 40%–50% from February levels, and overall spending is down 33%. As the economy recovers and spending increases, policymakers, financial services providers, and the media need to work to better explain how all these savings elements work together (which ultimately comes down to financial literacy).

Retirement saving by Millennials and Gen Z is almost certain to increase because these groups are pre-disposed to a savings mindset and are aware of ancillary savings and financial concerns such as aging parents and college debt. Obviously, the length of the financial recession, of course, will also have an impact on all of this.

What Happens with the Gig Economy?

As a reminder, there were roughly 55 million full-time workers with no access to a workplace retirement savings option pre-pandemic, and that number jumps to 80 million when you include part-time workers. How will the gig economy, whose members are a large part of that 80 million, play into all of this?

First, let’s take a look at some stats related to what the gig economy looks like.

- 28% of gig workers were full-time freelancers.

- 35% of all working Americans did some sort of freelance work in 2018.

- 43% of full-time gig workers were under 34 years old.

- 31% of gig workers earned more than $75,000.

Pre-pandemic, the gig economy was a rapidly growing sector of the workforce. When thinking about the future of this group, we first must consider which way the pendulum will swing. Will company mindsets shift toward hiring more freelance workers? Fewer?

Conclusion

Ultimately, how companies adjust to a distributed workforce, as well as the impact of economic recovery policies, will help determine the direction we are headed when it comes to retirement savings access in the workplace. The only thing we know for certain is that we need to collectively champion innovative and diverse solutions for more Americans to have access to saving for retirement through their work.

Kevin Boyles is Vice President of Workplace Savings Solutions at Millennium Trust Company, LLC. Boyles has nearly 20 years of experience in the retirement plan and health savings marketplace. The material in this blog is presented for informational purposes only. The information presented is not investment, legal, tax, or compliance advice. Millennium Trust Company performs the duties of a directed custodian, and as such, does not offer or sell investments or provide investment, legal, or tax advice.

Millennium Trust LLC is a supporter of the Center for Retirement Initiatives. The views and opinions expressed in this blog post are the views of the author and do not reflect any policy or position of the Center for Retirement Initiatives.

* The Millennium Trust Small Business Retirement Survey was commissioned by the Millennium Trust Company, and conducted by CITE Research (www.citeresearch.com). The online survey was conducted among 500 decision-makers at companies with fewer than 150 employees that do not offer any type of retirement savings option, and 500 employees who are working full-time for employers with no retirement savings option. The survey, one of the first of its kind to be conducted exclusively with employers that do not offer retirement benefits, was fielded between September 28 and October 8, 2018.

July 2020, 20-07

Additional Resources

The Pew Charitable Trusts (January 2016), “Who’s In, Who’s Out: A look at access to employer-based retirement plans and participation in the states,” Philadelphia, PA.

T. Rowe Price (December 2019), “Redefining the digital generation: Working Millennials Are Savers – And Worth Your Attention,” Baltimore, MD.

Broadridge and the Center for Generational Kinetics (2019), “Decoding the Millennial Mindset,” Lake Success, NY, and Austin, TX.

Digital Media Solutions (March 2020), “How Millennials Are Saving and Spending Their Money,” Clearwater, FL.

Georgetown CRI Webinar, COVID-19 & Retirement Savings: The Case for Protecting and Expanding Access and Participation, May 28, 2020. View replay or download slides (with presentation by Kevin Boyles).

Upwork (2018), “5th Annual Report: Freelancing in America 2018,” Santa Clara, CA.