State Programs 2025: Partnerships Continue to Expand and Several New Programs Will Launch

2025 STATE PROGRAM STATUS

As of October 21, 2025, there are 20 states that have enacted new programs for private sector workers (and also 2 cities (for a total of 22 programs), although the cities will not move forward to implement due to state legal and program actions) and 17 of these states are auto-IRA program states.

As of October 21, 2025, 16 of the 20 state programs (14 auto-IRA – CA, CO, CT, DE, IL, ME, MD, NJ, NV, NY, OR, RI, VT, VA) and 2 others – MA (MEP) and WA (Marketplace) are fully open to all eligible employers and workers. The RI auto-IRA program is the most recent program to open to all eligible employers and workers. The program launched on October 21, 2025.

The 2025 state legislative sessions are winding down for many states. As of June 30, 2025, program amendments have been enacted in Connecticut, Hawai’i, Massachusetts and Minnesota. Notably, Hawaii enacted legislation to switch from an opt-in model to an opt-out, automatic enrollment model, and Massachusetts raised the cap on its MEP program from employers with a maximum of 20 employees to employers with at most 100 employees. See the map below for updates about states that have introduced bills so far this year (green color) and state program implementation. Login required to view bill tracking and program updates.

In 2024, at least 27 states introduced legislation to establish new programs, amend existing programs, or form study groups to explore their options. Two new auto-IRA programs were enacted – Washington enacted a new auto-IRA program in addition to their already existing Retirement Marketplace and Rhode Island enacted a new auto-IRA program. The new programs that launched and opened to all eligible workers in 2024 included: Maine (January 2024), New Jersey (June 30, 2024), Delaware (July 1, 2024), and Vermont (December 2024).

In 2023, three new auto-IRA programs were enacted –Minnesota, Nevada, Vermont and one new Multiple Employer Plan (MEP) in Missouri. Vermont changed its existing program from a voluntary MEP to an auto-IRA program.

Since 2012, at least 49 states and the District of Columbia have acted to implement a new program, study program options, or consider legislation to establish state-facilitated retirement savings programs. Historically, there are one or two new programs enacted every year.

Below are some of the 2025 legislative highlights to date:

- Connecticut extended the definition of “covered employee” to personal care attendants, allowed the Comptroller to impose a penalty for noncompliant employers, tied the program’s default contribution rate to federal law for participants who enroll on or after July 1, 2025 and allowed the comptroller to provide an applicable retirement saving vehicle for participants who receive a federal Saver’s Match contribution.

- Hawaii enacted program amendments to switch the program to an auto-enrollment opt-out model, clarify the definition of “covered employer,” repeal the limit on the total fees and expenses and appropriate funds to the Department of Labor and Industrial Relations for the development and operation of the Program.

- Illinois enacted program amendments to provide that the accounts established shall be IRAs (offer both Roth and traditional options), that separate accounts shall be established and owned by each enrollee, and that enrollees can make contributions from multiple employers into a single account. Employers who fail to enroll an employee in the Program within the time provided and fail to remit their contributions shall be subject to a penalty.

- Massachusetts enacted program amendments to raise the cap on its MEP program from employers with a maximum of 20 employees to employers with at most 100 employees.

- Minnesota enacted program amendments to add temporary and seasonal workers to the definition of covered employees, add a certification process for employers that are not covered employers, detail program processes and timelines, and make other technical changes to the program.

2025 STATE LEGISLATIVE ACTION

Visit the CRI Supporters Homepage to access the 2025 state legislative map, detailed information on the progress of state program implementations, the State Resource Center and much more.

2025 State Program Information Map

Click on this map to view quick links for program states

Click here to view 2025 map with detailed state legislative activity updates (login required)

Source: Georgetown University’s Center for Retirement Initiatives

2025 STATE PROGRAM IMPLEMENTATION UPDATES

22 Programs (20 states and 2 cities)

To date, new programs have adopted one or a combination of these four models:

- Auto-IRA (employer participation required if no plan is already offered)

- Payroll deduction IRA (voluntary)

- Multiple Employer Plan (MEP) (voluntary)

- Marketplace (voluntary)

There are now 22 enacted retirement savings programs (20 states and 2 cities**) for private sector workers.

As of October 21, 2025, 16 of the 20 state programs (14 auto-IRA – CA, CO, CT, DE, IL, MD, ME, NJ, NV, NY, OR, RI, VA, VT) and 2 others – MA (MEP) and WA (Marketplace) are open to all eligible employers and workers. Rhode Island’s program opened to all eligible employers on October 21, 2025.

| Individual Retirement Account (Auto-IRA) |

Voluntary Payroll Deduction IRA | Voluntary Marketplace | Voluntary Open Multiple Employer Plan (MEP) |

|

California |

New Mexico***** | New Mexico Washington (active) |

Massachusetts (active) Missouri |

**New York City’s program will no longer be implemented because New York State enacted an auto-IRA program and New York City would now become part of the state program. The Seattle, WA program is on hold indefinitely pending state legislative action.

***Vermont has changed its state program from a voluntary MEP enacted in 2017 to an auto-IRA program in 2023. Program amendment legislation enacted in 2024 specifies the program should launch no later than July 1, 2026. The current timeline will launch the program well in advance of this deadline. The Vermont Saves Pilot Program, in partnership with Colorado, launched in October 2024. The program opened to all eligible employers and employees in December 2024. Employers were required to register by February 2025.

****Washington enacted a new auto-IRA program in March 2024, but it is not scheduled to launch until July 2027. Because WA already has a voluntary marketplace and it remains in place, the enactment of the new auto-IRA program does not increase the number of states with programs.

*****The New Mexico Work and $ave IRA Program was scheduled to be implemented on or before July 1, 2024, but has since been placed on an indefinite hold with no known new implementation date.

For an overview of all the state programs (with hyperlinks to state program websites and additional information), see State-Facilitated Retirement Savings Programs: A Snapshot of Plan Design Features (23-03, June 30, 2023 UPDATE).

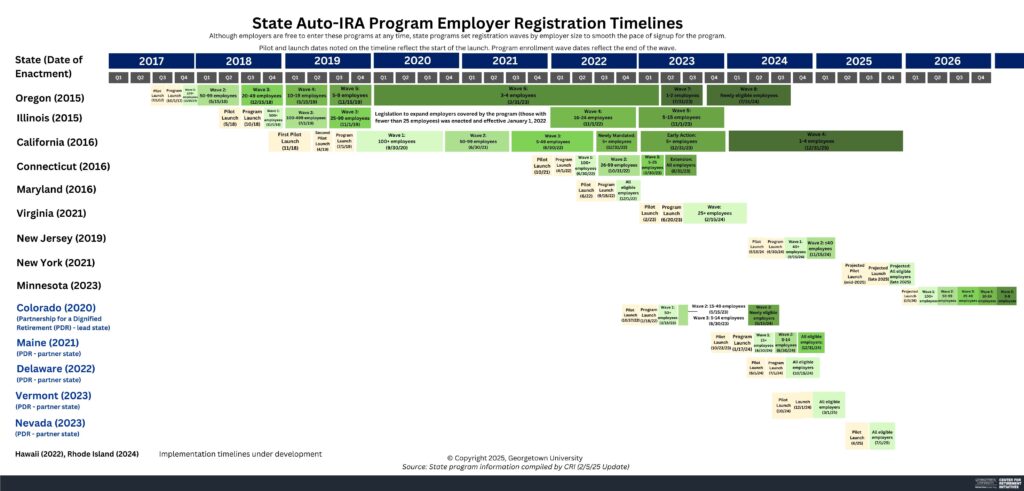

PROGRAM LAUNCH AND EMPLOYER TIMELINES

The lessons from older auto-IRA programs (i.e., OR, IL, and CA) suggest that state programs can shorten their timelines for onboarding employers. Also, the creation of new inter-state partnerships supports shorter launch and onboarding timelines, as illustrated by the more recent launch of Maine’s MERIT program.

Auto-IRA programs:

California: The Board launched a pilot program in November 2018 and statewide enrollment began on July 1, 2019. Registration was initially implemented in three waves: Wave 1 with employers with 100 or more employees required to register by September 30, 2020; Wave 2 with employers with 50 or more employees required to register by June 30, 2021; and Wave 3 with employers with 5 or more employees required to register by June 30, 2022. There was a wave for employers that had not yet received a registration notice, who were required to register by December 31, 2023. The final wave, for employers with 1-4 employees, closes on December 31, 2025.

Colorado: The Colorado Secure Savings Program launched its pilot program on October 17, 2022 and statewide enrollment began in January 18, 2023 in three waves: Wave 1 with employers with 50+ employees required to register by March 15, 2023; Wave 2 with employers with 15-49 employees required to register by May 15, 2023; and Wave 3 with employers with 5-14 employees, to register by June 30, 2023. Each year, businesses that are newly eligible as of April are required to register by May 15th of that year.

Connecticut: MyCTSavings launched its employer pilot program on October 25, 2021 and opened to all eligible employers on April 1, 2022 in three waves: Wave 1 with employers with 100 or more employees required to register by June 30, 2022; Wave 2 with employers with 26-99 employees required to register by October 31, 2022; and Wave 3 with emploeyrs with 5-25 employees required to register by March 30, 2023. The program deadline for all employers was extended to August 31, 2023. Following the three planned waves, newly eligible businesses were required to register by August 3, 2024.

Delaware: The DE EARNS Pilot Program for employers and employees launched on May 1, 2024. The full program opened to all eligible employers on July 1, 2024. Employers were required to register by October 15, 2024. Newly eligible businesses were then required to register by June 30, 2025.

Hawaii: The implementation schedule is still under development.

Illinois: Illinois Secure Choice launched its pilot program in May 2018. Statewide enrollment opened to all eligible employers in October 2018 in three initial registration waves: Wave 1 with employers with more than 500 employees required to register by November 2018; Wave 2 with employers with 100-499 employees required to register by July 2019; and Wave 3 with employers with 25-99 employees required to register by November 2019. In 2021, with the statutory lowering of the threshold from 25 to 5 employees, two additional employer registration waves were added: Wave 4 with employers with 16–24 employees required to register by November 1, 2022; and Wave 5 with employers with 5–15 employees required to register by November 1, 2023. Each year from 2024 forward, the program has an annual employer onboarding wave comprising employers newly covered by the Act.

Maine: MERIT opened its Pilot Program for employers and employees on October 23, 2023. The full program launch, open to all eligible employers, began on January 27, 2024 in three waves: Wave 1 with employers with 15 or more employees required to register by April 30, 2024; Wave 2 with employers with less than 15 employees required to register by June 30, 2024; and Wave 3 with all remaining covered employers required to register by December 31, 2024.

Maryland: MarylandSaves launched its pilot in March 2022 and the full program launched on September 15, 2022. Employers were required to register by December 1, 2022.

Minnesota: The program will soft launch for any sized covered employer from January 1, 2026 – March 30, 2026. The full program launch will begin on April 1, 2026 in five waves: Wave 1 with employers with 100 or more employees required to register by June 30, 2026; Wave 2 with employers with 50-99 employees required to register by December 1, 2026; Wave 3 with employers with 25-49 employees required to register by June 30, 2027; Wave 4 with employers with 10-24 employees required to register by December 31, 2027; Wave 5 with employers with 5-9 employees required to register by June 30, 2028.

Nevada: The Nevada Employee Savings Trust (NEST) opened to all eligible employers on June 9, 2025. All employers are required to register by September 1, 2025.

New Jersey: The New Jersey Secure Choice Savings Pilot Program for employers and employees launched on May 15, 2024. The full program opened to all eligible employers on June 30, 2024 in two registration waves: Wave 1 with employers with 40 or more employees required to register by September 15, 2024; and Wave 2 with employers with 25-39 employees required to register by November 15, 2024.

New York: New York Secure Choice launched its program pilot on July 14, 2025. The full program opened to all eligible employers and workers on October 8, 2025. There are three registration deadline waves: Wave 1 with employers with 30 or more employees required to register by March 18, 2026; Wave 2 with employers with 15-29 employees required to register by May 15, 2026; Wave 3 with employers with 10-14 employees required to register by July 15, 2026.

Oregon: OregonSaves launched its pilot on July 1, 2017. Statewide enrollment opened to all eligible employers on October 1, 2017 in seven registration waves: Wave 1 with employers with 100+ employees required to register by November 15, 2017; Wave 2 with employers with 50-99 employees required to register by May 15, 2018; Wave 3 with employers with 20-49 employees required to register by December 15, 2018; Wave 4 with employers with 10-19 employees required to register by May 15, 2019; Wave 5 with employers with 5-9 employees required to register by November 11, 2019; Wave 6 with employers with 3-4 employees required to register by March 1, 2023; and Wave 7 with employers with 1-2 employees or using a Professional Employer Organization (PEO) or Leasing Agency required to register by July 31, 2023. Each year, newly eligible employers are required to register by July 31st of the next year.

Rhode Island: On September 24, 2025, the state announced the completion of its partnership agreement with Connecticut. The program is formally open as of October 21, 2025, with three registration waves: Wave 1 with employers with 100 or more employees required to register by October 21, 2026; Wave 2 with employers with 50 or more employees required to register by October 21, 2027; Wave 3 with employers with 5 or more employees required to register by October 21, 2028.

Vermont: The Vermont Saves Pilot Program launched its pilot program in October 2024. The program opened to all eligible employers and employees on December 1, 2024. Employers were required to register by March 1, 2025.

Virginia: The RetirePathVA retirement savings program facilitated by the Commonwealth Savers Plan opened its pilot program on February 23, 2023, and the program opened to all eligible employers on June 20, 2023. All employers were required to register by February 15, 2024.

Washington: According to the legislation, Washington Saves must be launched by July 1, 2027 and current timeline targets a pilot on or about April 2027 with full launch by July 2027.

Other State Programs: The Massachusetts’ CORE MEP opened for enrollment in October 2017, and the Washington State Retirement Marketplace opened in March 2018. According to the legislation, the Missouri MEP plan should launch by September 1, 2025, but no official implementation schedule has been released. The New Mexico Retirement Plan Marketplace and the New Mexico Work and $ave IRA Program had a July 1, 2024 implementation deadline, but the implementation date has since been delayed with no new date set.

State Partnerships: To date, 8 of the 17 auto-IRA programs have entered partnership agreements, and there are two distinct partnership arrangements. In 2023, Colorado established the first partnership, creating the Colorado Partnership for a Dignified Retirement (PDR), and it has the following member states as of June 30, 2025 (in order of entrance): Maine, Delaware, Vermont, Nevada and Minnesota. The second partnership arrangement was established in 2024 when Rhode Island announced its intent to partner with the already established MyCTSavings Program (Connecticut) (View press release).

Colorado Partnership for a Dignified Retirement Timeline

- At its June 17, 2025 board meeting, the Minnesota Secure Choice Retirement Program announced its intent to enter the Colorado Partnership for a Dignified Retirement.

- On December 17, 2024, the Nevada Employee Savings Trust (NEST) announced its intent to enter the Colorado Partnership for a Dignified Retirement. On April 30, 2025, Colorado officially announced that Nevada had entered the Partnership for a Dignified Retirement (View press release).

- On June 26, 2024, the Colorado Secure Savings Program and Vermont Saves announced a partnership (View press release).

- On December 7, 2023, the Delaware EARNS board approved negotiating a final partnership agreement with the Colorado Partnership for a Dignified Retirement (View press release).

- In June 2023, the Colorado Secure Savings Program and the Maine Retirement Investment Trust agreed to finalize the details of an interstate partnership, which was officially announced on August 15, 2023 (View press release).

- In November 2021, the Colorado Secure Savings Program and the New Mexico Work and $ave Program signed a first-in-the-country Memorandum of Cooperation (MoC) to pursue a formalized partnership agreement for their auto-enroll IRA programs. The MoC highlights areas of collaboration including shared program administration and financial services, marketing and outreach support, program evaluation and research, as well as data collection and participant privacy. As of June 2025, the Colorado and New Mexico partnership is currently on hold pending additional potential modifications to the design of the New Mexico state program.

MyCTSavings Partnership with RISavers Timeline

- On October 21, 2025, the RISavers program opened to all eligible employers. Read the announcement.

- On September 24, 2025, Connecticut and Rhode Island announced the finalization of their partnership agreement that will now support the launch the new RISavers program.

- On November 20, 2024, Rhode Island Treasurer announced the intent of the Rhode Island Savers Program to partner with the MyCTSavings Program (View press release).