State Program Performance Data – Tableau Test

- Monthly State Program Data & Trends

- Monthly Individual State Program Specific Data & Trends

- Quarterly State Program Performance Data & Trends

- Annual and Semi-Annual State Program Performance Data & Trends

* Data under each of these sections above is from state auto-IRA programs and cumulative across all programs, unless otherwise noted (e.g., the monthly individual state program specific data).

Monthly Individual State Program Specific Data & Trends

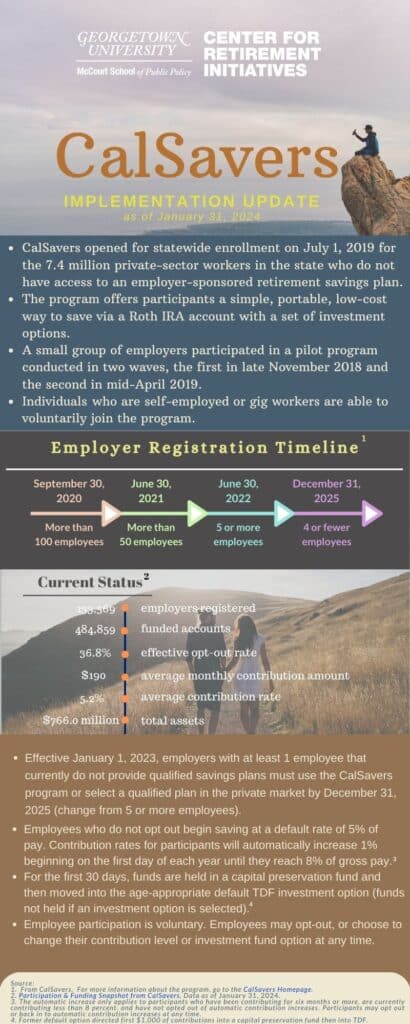

California

Program Performance Indicators, Monthly Percent Change

(as of January 31, 2023)

| 12/31/22 | 1/31/23 | Percent Change

12/31/22 -1/31/23 |

|

| Total Assets | $372,979,988 | $423,386,300 | 13.5% |

| Total Funded Accounts | 395,972 | 403,090 | 1.8% |

| Total Withdrawals | $68,275,908 | $75,909,514 | 11.2% |

| Accounts with Withdrawals | 69,577 | 74,678 | 7.3% |

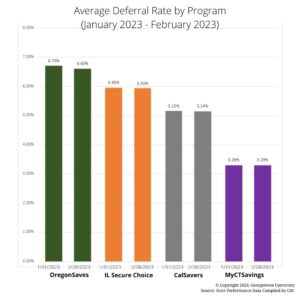

| Average Deferral Rate | 5.07% | 5.15% | |

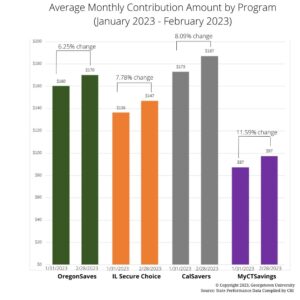

| Average Monthly Contribution Amount | $169 | $173 | 2.4% |

| Average Funded Account Balance | $942 | $1,050 | 11.5% |

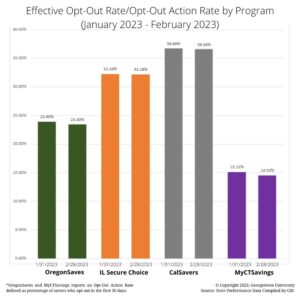

| Effective Opt Out Rate | 36.84% | 36.69% | |

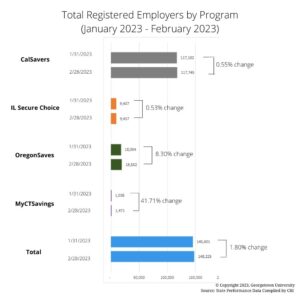

| Total Registered Employers | 115,705 | 117,102 | 1.2% |

| Employers That Added Employee Data | 94,552 | 96,632 | 2.2% |

| Employers Submitting Payroll Deductions (last 90 days) | 33,802 | 34,290 | 1.4% |

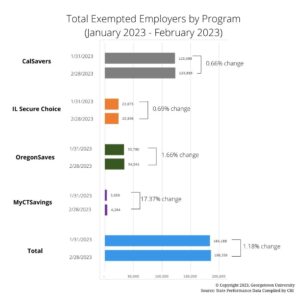

| Total Exempted Employers | 119,103 | 123,085 | 3.3% |

| Source: Calculations by the Georgetown University Center for Retirement Initiatives based on data from CalSavers | |||

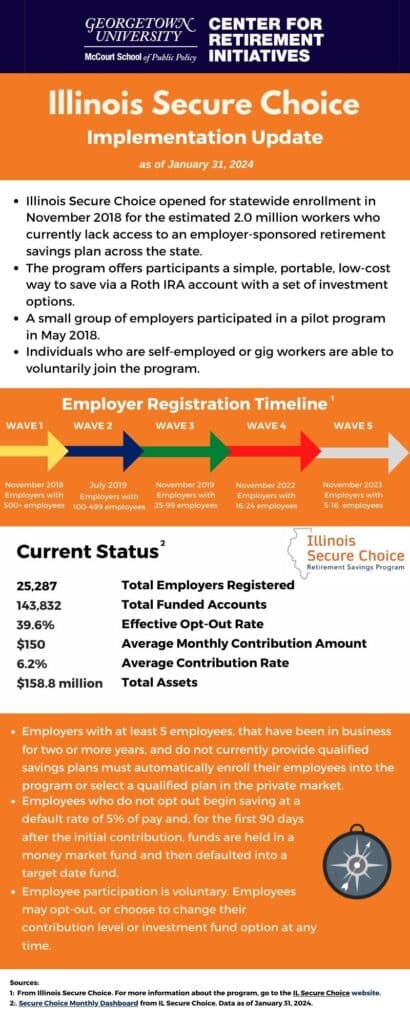

Illinois

Program Performance Indicators, Monthly Percent Change

(as of February 28, 2023)

| 01/31/23 | 02/28/23 | Percent Change 01/31/23-02/28/23 | |

| Total Assets | $107,430,269 | $106,850,685 | -0.5% |

| Total Funded Accounts | 118,218 | 119,906 | 1.4% |

| Total Withdrawals | $30,625,588 | $32,005,483 | 4.5% |

| Accounts with Withdrawals | 28,641 | 29,378 | 2.6% |

| Average Deferral Rate | 5.95% | 5.93% | |

| Average Monthly Contribution Amount | $136.21 | $146.81 | 7.8% |

| Average Funded Account Balance | $908.75 | $891.12 | -1.9% |

| Effective Opt Out Rate | 32.24% | 32.16% | |

| Total Registered Employers | 9,407 | 9,457 | 0.5% |

| Employers That Added Employee Data | 7,445 | 7,624 | 2.4% |

| Employers Submitting Payroll Deductions (last 90 days) | 3,360 | 3,520 | 4.8% |

| Total Exempted Employers | 23,673 | 23,836 | 0.7% |

| Source: Calculations by the Georgetown University Center for Retirement Initiatives based on data from IL Secure Choice. | |||

Oregon

Program Performance Indicators, Monthly Percent Change

(as of January 31, 2023)

| 12/31/2022 | 1/31/2023 | Percent Change

12/31/22-1/31/23 |

|

| Total Assets | $168,705,846 | $182,053,048 | 7.9% |

| Total Funded Accounts | 115,863 | 114,514 | -1.2% |

| Total Withdrawals | $70,672,308 | $73,965,180 | 4.7% |

| Accounts with Withdrawals | 34,521 | 35,970 | 4.2% |

| Average Deferral Rate | 6.0% | 6.7% | |

| Average Monthly Contribution Amount | $157 | $160 | 1.9% |

| Average Funded Account Balance | $1,456 | $1,590 | 9.2% |

| Opt-Out Action Rate | 24.1% | 23.9% | |

| Total Registered Employers | 17,671 | 18,054 | 2.2% |

| Employers That Added Employee Data | 16,059 | 16,496 | 2.7% |

| Employers Submitting Payroll Deductions (last 90 days) | 5,234 | 5,261 | 0.52% |

| Total Exempted Employers | 33,657 | 33,780 | 0.37% |

| Source: Calculations by the Georgetown University Center for Retirement Initiatives based on data from OregonSaves. Opt-out Action Rate = savers who opt-out only within the last 30 days | |||

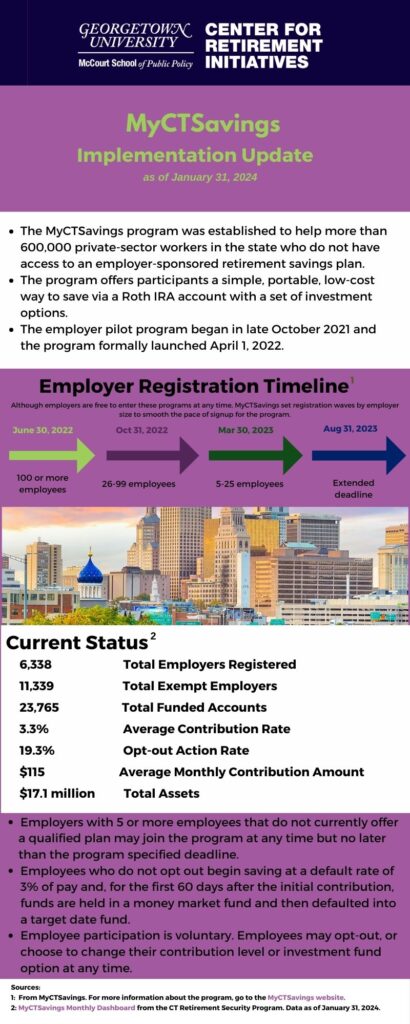

Connecticut

Program Performance Indicators, Monthly Percent Change

(as of January 31, 2023)

| 12/31/22 | 1/31/23 | Percent Change

12/31/22- |

|

| Total Assets | $1,573,216 | $2,152,738 | 36.8% |

| Total Funded Accounts | 6,766 | 7,617 | 12.6% |

| Total Withdrawals | $26,791 | $58,349 | 117.8% |

| Accounts with Withdrawals | 149 | 236 | 58.4% |

| Average Deferral Rate | 3.24% | 3.29% | |

| Average Monthly Contribution Amount | $98 | $87 | -10.8% |

| Average Funded Account Balance | $233 | $283 | 21.6% |

| Opt-Out Action Rate | 23.4% | 21.4% | |

| Total Registered Employers | 876 | 1,038 | 18.5% |

| Employers Submitting Payroll Deductions (last 90 days) | 392 | 465 | 18.6% |

| Total Exempted Employers | 3,488 | 3,650 | 4.6% |

| Source: Calculations by the Georgetown University Center for Retirement Initiatives based on data from MyCTSavings. Opt-out Action Rate = savers who opt-out only within the last 30 days | |||

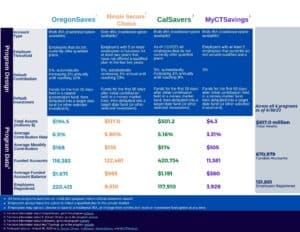

Monthly Cumulative State Program Performance Metrics (CA, IL, OR, and CT)

Program Performance Indicators

Monthly Percent Change

(as of January 31, 2023)

| 12/31/22 | 1/31/23 | Percent Change 12/31/22-1/31/23 | |

| Total Assets | $641,725,469 | $715,022,356 | 11.4% |

| Total Funded Accounts | 634,817 | 643,439 | 1.4% |

| Total Registered Employers | 143,564 | 145,601 | 1.4% |

| Employers That Added Employee Data¹ | 117,822 | 120,573 | 2.3% |

| Employers Submitting Payroll Deductions (Past 90 Days) | 42,472 | 43,376 | 2.1% |

| Exempted Employers | 179,622 | 184,188 | 2.5% |

| ¹Excludes data from MyCTSavings

Source: Calculations by the Georgetown University Center for Retirement Initiatives based on data from CalSavers, IL Secure Choice, and OregonSaves. |

|||

Quarterly State Program Performance Data & Trends

California

| 12/31/21 | 6/30/22 | Percent Change 12/31/21-6/30/22 | 9/30/22 | 12/31/22 | Percent Change 9/30/22-12/31/22 | Percent Change

12/31/21-12/31/22 |

|

| Total Assets | $173,022,007

|

$223,049,153 | 28.9% | $272,215,635 | $372,979,988 | 37.0%

|

115.6%

|

| Total Funded Accounts | 217,892

|

276,862 | 27.1% | 360,237 | 395,972 | 9.9%

|

81.7%

|

| Total Withdrawals | $20,493,838

|

$40,893,704 | 99.5% | $53,300,368

|

$68,275,908 | 28.1% | 233.2%

|

| Accounts with Withdrawals | 32,923

|

48,693 | 47.9% | $58,869 | $69,577 | 18.2%

|

111.3%

|

| Average Deferral Rate | 5.02%

|

5.08% | 5.07% | 5.07% | |||

| Average Monthly Contribution Amount | $150

|

$168 | 12.0% | $166 | $169 | 1.8%

|

12.7%

|

| Average Funded Account Balance | $794

|

$806 | 1.5% | $756 | $942 | 24.6%

|

18.6%

|

| Effective Opt Out Rates | 29.74% | 36.64% | 37.41% | 36.84% | |||

| Total Registered Employers | 23,203

|

98,417 | 324.2% | 109,245 | 115,705 | 5.9%

|

398.7%

|

| Total Added Employee Data | 15,008 | 63,474 | 322.9% | 88,498 | 94,552 | 6.8%

|

530.0%

|

| Employers Submitting Payroll

Deductions (last 90 days) |

N/A | 13,755¹ | 53.5% | 31,051

|

33,802 | 8.9%

|

N/A

|

| ¹I¹California began reporting Actively Submitting Payroll (Past 90 Days) on February 28, 2022.

Source: Calculations by the Georgetown University Center for Retirement Initiatives based on data from CalSavers. |

|||||||

Illinois

| 12/31/21

|

6/30/22 | Percent Change 12/31/21-6/30/22

|

9/30/22

|

12/31/22

|

Percent Change 9/30/22-12/31/22

|

Percent Change

12/31/21-12/31/22

|

|

| Total Assets | $84,871,970 | $82,742,994 | -2.5%

|

$83,977,073 | $98,466,419 | 17.3%

|

16.0%

|

| Total Funded Accounts | 99,082 | 105,459 | 6.4%

|

109,346 | 116,216 | 6.3%

|

17.3%

|

| Total Withdrawals | $15,539,645 | $22,369,318 | 43.9%

|

$25,695,321 | $28,766,940 | 12.0%

|

85.1%

|

| Accounts with Withdrawals | 20,796 | 24,625 | 18.4%

|

26,094 | 27,506 | 5.41% | 32.27% |

| Average Deferral Rate | 5.05% | 5.56% | 5.53% | 5.49% | |||

| Average Monthly Contribution Amount | $118.19 | $135.14 | 14.3%

|

$144 | $131 | -9.5%

|

10.5%

|

| Average Funded Account Balance | $856.58 | $784.60 | -8.4% | $768 | $847 | 10.3%

|

-1.1%

|

| Effective Opt Out Rates | 33.30% | 32.80% | 31.92% | 32.17% | |||

| Total Registered Employers | 6,408 | 6,498 | 1.4%

|

7,486 | 9,312 | 24.4%

|

45.32% |

| Total Added Employee Data | 4,315 | 4,450 | 3.1%

|

5,148 | 7,211 | 40.1% | 67.1% |

| Employers Submitting Payroll Deductions (last 90 days) | N/A | 2,333¹ | N/A

|

2,404 | 3,044 | 26.6% | N/A |

| ¹Illinois began reporting Actively Submitting Payroll (Past 90 Days) on April 30, 2022.

Source: Calculations by the Georgetown University Center for Retirement Initiatives based on data from IL Secure Choice. |

|||||||

Oregon

| 12/31/21 | 6/30/22 | Percent Change 12/31/21-6/30/22 | 9/30/22 | 12/31/22

|

Percent Change 9/30/22-12/31/22

|

Percent Change

12/31/21-12/31/22

|

|

| Total Assets | $150,010,539 | $146,004,291 | -2.7% | $148,185,293 | $168,705,846 | 13.9% | 12.5%

|

| Total Funded Accounts | 112,689 | 115,046 | 2.1% | 115,569 | 115,863 | 0.3% | 2.8%

|

| Total Withdrawals | $39,274,450 | $54,286,395 | 38.2% | $62,368,689 | $70,672,308 | 13.3% | 79.9%

|

| Accounts with Withdrawals | 20,314 | 27,577 | 35.8% | 31,153 | 34,521 | 10.8% | 69.9%

|

| Average Deferral Rate | 5.60% | 6.20% | 6.10% | 6.00% | |||

| Average Monthly Contribution Amount | $166 | $176 | 6.0% | $159 | $157 | -1.3% | -5.4% |

| Average Funded Account Balance | $1,331 | $1,269 | -4.7% | $1,282 | $1,456 | 13.6% | 9.4%

|

| Effective Opt Out Rates | *N/A | 25.6%1 | 24.8%1 | 24.1%1 | |||

| Total Registered Employers | 17,025 | 17,037 | 0.07% | 17,187 | 17,671 | 2.8% | 3.8%

|

| Total Added Employee Data | 14,931 | 15,146 | 1.4% | 15,516 | 16,059 | 3.5% | 7.6%

|

| Employers Submitting Payroll Deductions (last 90 days) | N/A | 5,2802 | N/A | 5,2622 | 5,234 | -0.53% | N/A |

| 1In March 2022, OregonSaves began reporting an Opt-Out Action Rate defined as percentage of savers who opt out in the first 30 days.

2Oregon replaced Total submitting Payroll Contributions with Actively Submitting Payroll (Past 90 Days) on March 30, 2022. |

|||||||

Quarterly Cumulative State Program Performance Metrics (CA, IL, and OR)

| 12/31/21 | 6/30/2022

|

Percent Change 12/31/22-6/30/22 | 9/30/22

|

12/31/22

|

Percent Change 9/30/22-12/31/22

|

Percent Change

12/31/21-12/31/22

|

|

| Total Assets | $407,904,516 | $451,796,438 | 12.40% | $504,378,001 | $640,152,253 | 26.9% | 56.9%

|

| Total Funded Accounts | 429,663 | 497,367 | 0.01% | 585,152 | 628,051 | 7.3% | 46.2% |

| Total Registered Employers | 46,636 | 121,952 | 0.02% | 133,918 | 142,688 | 6.5% | 206.0% |

| Total Added Employee Data | 34,254 | 83,070 | 0.28% | 109,162 | 117,822 | 7.9% | 244.0% |

| Employers Submitting Payroll Deductions (last 90 days) | N/A | 22,114¹ | N/A | 39,581¹ | 42,994¹ | 8.6% | N/A |

| 1Oregon replaced Total submitting Payroll Contributions with Actively Submitting Payroll (Past 90 Days) on March 30, 2022.

Source: Calculations by the Georgetown University Center for Retirement Initiatives based on data from CalSavers, IL Secure Choice, and OregonSaves. |

|||||||

Semi-Annual and Annual State Program Performance Data & Trends

Semi-Annual and Annual State Program Performance Metrics (CA, IL, and OR)

| 12/31/21 | 6/30/2022 | Percent Change 12/31/22-6/30/22 | 12/31/22 | Percent Change 6/30/22-12/31/22 | Percent Change

12/31/21-12/31/22 |

|

| Total Assets | $407,904,516 | $451,796,438 | 10.76% | $640,152,253 | 41.69% | 56.9% |

| Total Funded Accounts | 429,663 | 497,367 | 15.76% | 628,051 | 26.28% | 46.2% |

| Total Registered Employers | 46,636 | 121,952 | 161.50% | 142,688 | 17.00% | 206.0% |

| Total Added Employee Data | 34,254 | 83,070 | 142.51% | 117,822 | 41.83% | 244.0% |

| Employers Submitting Payroll (Past 90 Days) | N/A | 22,114¹ | N/A | 42,994¹ | 94.42% | N/A |

| ¹In March 2022 (as part of April 30, 2022 dashboard report), OregonSaves began reporting Actively Submitting Payroll (Past 90 Days) instead of Total Submitting Payroll. Source: Calculations by the Georgetown University Center for Retirement Initiatives based on data from CalSavers, IL Secure Choice, and OregonSaves. |

||||||